Westpac Banking Corp (ASX: WBC) shares are in the headlines today on speculation that the ASX bank share's current CEO, Peter King, may be on the way out this year.

Peter King was appointed as the Westpac CEO in April 2020 after holding the role on an acting basis between December 2019 and March 2020. He joined Westpac in 1994 after holding various roles, including chief financial officer.

Is Peter King leaving?

According to reporting by The Australian, Westpac is actively looking to replace Peter King by the end of the year.

In recent meetings with the new chair Steven Gregg, a few investors and analysts were told that Westpac is searching for a new boss, The Australian's sources said.

While a change was expected to happen eventually, the speed of the shift may surprise some investors.

Up until now, Westpac hasn't publicly acknowledged it's looking for a new CEO, though in July it did suggest a change may occur within a few years. When contacted by The Australian, a spokesman for the bank reportedly declined to comment.

Has the Westpac share price done well?

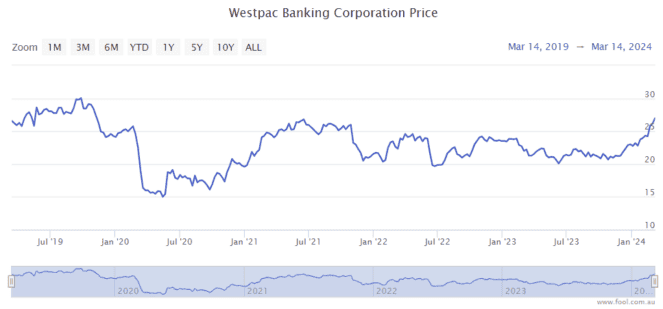

Thanks to the recent rally of the Westpac share price, it's up more than 10% since King became the acting CEO. But, it has risen more than 70% since Peter King was appointed as the official CEO.

The recent FY24 first quarter was not exactly inspiring, with the core net interest margin (NIM) of 1.80% falling 4 basis points (0.04%) compared to the second half of FY23.

The underlying net profit after tax (NPAT), which excludes notable items, was $1.8 billion and it was flat compared to the quarterly average of the FY23 second half. The actual net profit was $1.5 billion, down 6% on the FY23 second-half quarterly average.

Time will tell how the bank performs in this rising-arrear environment and what a new CEO can bring to the table.

Westpac share price snapshot

Since the start of 2024, the Westpac share price is up close to 20%.