ASX growth shares that are soaring rapidly are obviously exciting and rewarding to own.

But, of course, one must always remember with reward comes risk. Not every hyper-growth stock you buy will end up a 10-bagger. Probably not even the majority of them.

If it were easy, then everyone would be doing it, and we'd all be billionaires.

But if you keep the risks in mind and do careful research then you can make some educated guesses as to which stocks will end up much higher in a few years.

Then you diversify by buying a few of these and see which ones work out.

Here are three high-growth ASX shares that I like at the moment:

A fast recovery from tough times

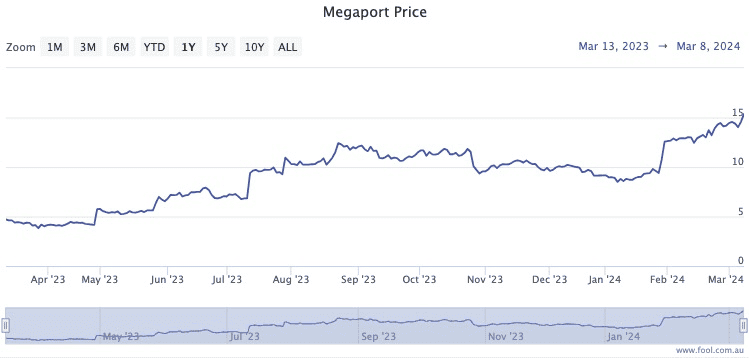

Megaport Ltd (ASX: MP1) is one that I sold off last August. I am embarrassed to say it's gone from strength to strength since.

In fact, the share price has rocketed 42% since I offloaded it seven months ago.

If you go back to April last year, though, Megaport has returned a stunning 268% for its investors.

The performance is amazing, considering it was only this time last year when the chief executive resigned suddenly, and the market punished the stock.

With a new boss at the helm, the virtual networking provider has convinced investors that it's successfully cutting costs, increasing profits and expanding its customer base.

A massive 10 out of 15 analysts covering Megaport currently rate it as a strong buy, according to broking app CMC Invest.

All up, Megaport shares are 257% higher now than they were five years ago.

ASX growth shares with all the right signals

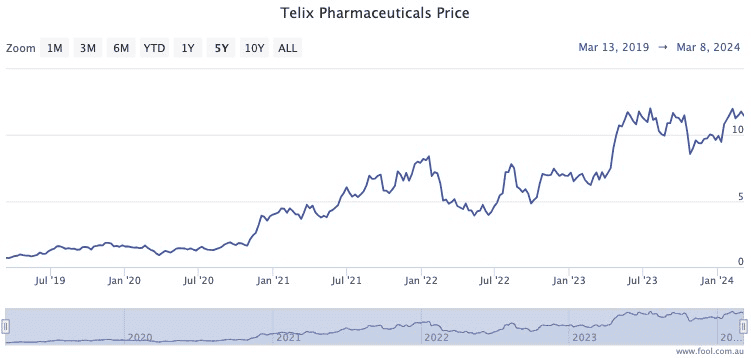

One I've pleasingly held onto is Telix Pharmaceuticals Ltd (ASX: TLX).

The cancer drug company has consistently kicked goals over the last five years, showing in its share price returning an incredible 1,578% over that time.

Despite its meteoric rise, the professionals are banking on even more to come.

The analysts at Bell Potter love the Melbourne company's recently revealed acquisition of Canadian outfit ARTMS Inc.

"The acquisition is crucial for the supply of 89Z and the pending rollout of Zircaix for renal cancer imaging," the team said in a memo.

"Telix is validating multiple production locations for 89Zr in the US using the ARTMS core technology. The company also owns significant quantities of ultra-pure 89Y, being the raw material for production of 89Zr."

Tellingly, all eight analysts surveyed on CMC Invest insist Telix is a buy.

Hit the jackpot

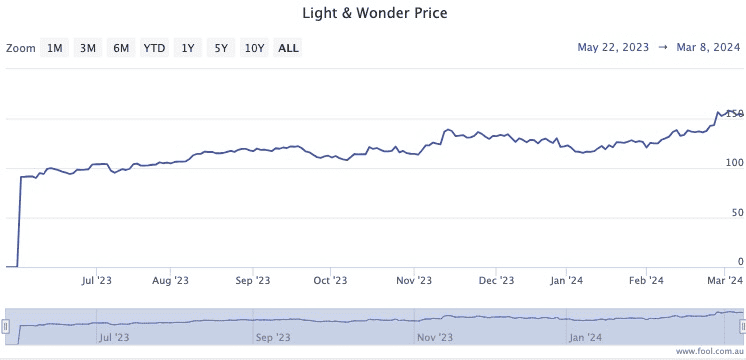

A growth stock that's caught my attention recently is Light & Wonder Inc CDI (ASX: LNW), which is dual-listed here and on the Nasdaq.

As a poker machine maker, the Las Vegas company is a competitor to Australia's own Aristocrat Leisure Limited (ASX: ALL).

Light & Wonder was only listed on the ASX last May, but shares have soared 68% from its first-day price.

With a December year-end, the company revealed its 2023 results during reporting season, and its metrics were bullish:

- Revenue up 16% to $2.9 billion

- Net income turned around from a $176 million loss to $180 million gain

- Net cash from operating activities turned around from a $381 million loss to $590 million gain

All eight analysts currently surveyed on CMC Invest rate the stock as a buy.