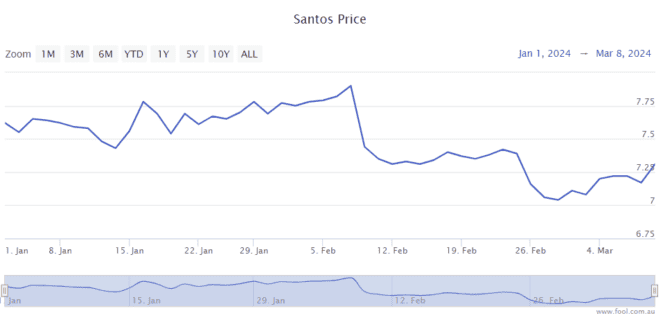

Santos Ltd (ASX: STO) shares have dropped in the last few weeks, falling 7% since the end of January. This follows the breakdown in merger talks between Santos and Woodside Energy Group Ltd (ASX: WDS).

But one fund manager is excited by the energy company's potential.

Why Santos shares are attractive

The fund manager L1 pointed out that Santos was continuing to review options to unlock shareholder value.

According to L1, Santos' asset base was "materially undervalued by the market". The fund manager believed the company had "attractive structural options" to unlock this value, regardless of a transaction needing to occur with a third party.

One of the positives for Santos is that it continues to make "material progress" on its key growth initiatives, with the Barossa project nearly 70% complete and on track for first production in 2025, while the Pikka project is nearly 40% complete.

L1 said:

We anticipate that Santos will have one of the most attractive cash flow profiles globally in the sector in 2026 when both major projects have been completed.

Valuation

Currently, the forecast for Santos shares on Commsec is that it could make earnings per share (EPS) of 58.7 cents in FY24 and 74.8 cents in FY26. That would put the Santos share price at 12x FY24's estimated earnings and under 10x FY26's estimated earnings.

If it does generate that sort of profit, the company is forecast to pay a dividend yield of 5.5% in FY26. In FY24, it could pay a dividend yield of 4.3%.

The dividends are currently unfranked, meaning no franking credits are attached.

Broader market comments

Talking about the overall market, L1 said:

We expect global markets to oscillate based on future economic data updates as Central Banks attempt to navigate 'soft landing' outcomes. Ongoing geopolitical tensions, war in the Middle East and potential impacts from events such as the US elections provide an additional layer of uncertainty.

Against this backdrop, recent equity market performance has been driven primarily by a narrow group of technology/AI stocks.

The fund manager said it saw equity markets as being "relatively fully priced overall".

… but within that we see numerous compelling opportunities in low P/E, highly cash generative companies, along with select opportunities on the short side, particularly in some expensive growth stocks with overly optimistic market expectations.