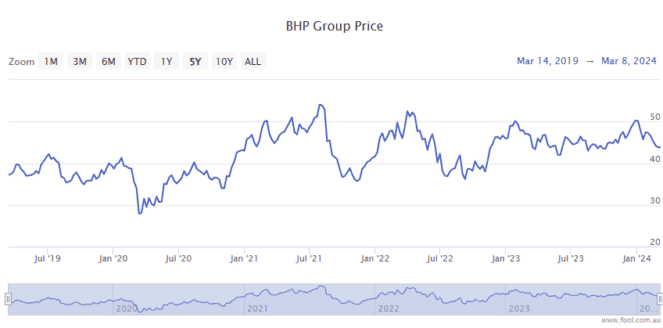

The BHP Group Ltd (ASX: BHP) share price is taking a beating today.

Shares in the S&P/ASX 200 Index (ASX: XJO) mining giant closed down 2.6% yesterday at $42.82. In late morning trade on Tuesday, shares are swapping hands for $42.43, down 0.9%.

For some context, the ASX 200 is up 0.4% at this same time.

Here's what's going on.

What's pressuring the BHP share price?

Most of the headwinds battering the BHP share price today stem from a big overnight fall in the iron ore price.

Iron ore counts as BHP's top revenue earner. And the price of the critical steel-making metal tumbled 6.8% overnight to trade for US$107.35 per tonne. That's down from US$145 per tonne in early January, and well below many analyst forecasts that predicted iron ore would hold above US$120 per tonne for the first half of 2024.

That looks to be because China's floundering economy has thus far failed to reignite. And the Chinese government's stimulus efforts to date have been on the decidedly timid side of the spectrum.

China is Australia's top import market for iron ore and many basic commodities. And its often booming real estate sector consumes mind-boggling quantities of steel. But the property markets in China have been weak, with iron ore stockpiles building.

And the outlook remains cloudy, which sees both iron ore and the BHP share price taking a big hit this week.

Commenting on the headwinds facing the industry, Daniel Hynes, a senior commodity strategist at ANZ Group Holdings Ltd (ASX: ANZ) said (quoted by The Australian Financial Review), "China's latest National People's Congress meeting didn't ease prospects for the property market and a weak start to the construction season is boding ill for steel demand."

Tom Price, senior commodities analyst at Liberum added:

It's hard to build a bullish case for iron ore over any time horizon at the moment. There's probably a speculative element at work today, with investors looking at what it will take for China to hit its growth targets for the year and deciding that it's just not going to happen.

With doubts about China's 2024 growth prospects simmering, the BHP share price could be entering bargain territory if the Chinese economy regains traction.