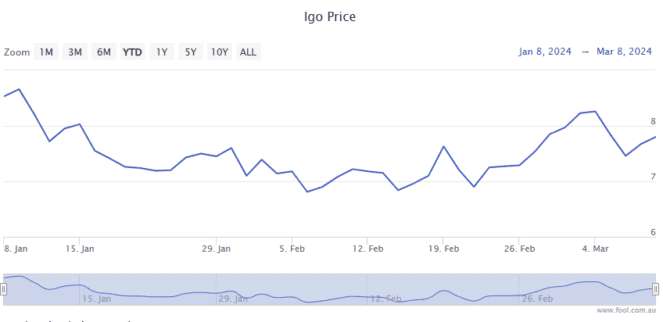

The IGO Ltd (ASX: IGO) share price is marching higher today.

Shares in the S&P/ASX 200 Index (ASX: XJO) lithium stock closed yesterday trading for $7.56. In morning trade on Tuesday, shares are swapping hands for $7.73 apiece, up 2.3%.

For some context, the ASX 200 is up 0.2% at this same time.

Here's what's happening.

IGO share price rises on ex-dividend day

Investors never like seeing one of their stock holdings retrace.

And the good news for shareholders in this ASX 200 resource producer is that despite IGO trading ex-dividend today, the IGO share price is in the green.

When a stock trades without the rights to the dividend, it's common to see the share price fall to reflect this. But after IGO closed down 3.3% yesterday, investors are shaking off the fact they won't be entitled to the greatly reduced interim dividend, buying the stock at what could be a bargain entry point today.

IGO reported its half-year results (H1 FY 2024) on 22 February.

And those results confirmed that the miner had clearly been under pressure from falling lithium and commodity prices.

Those falling prices saw IGO's half-year revenue decrease by 19% year on year to $438 million.

And with net profit after tax (NPAT) down 53% to $288 million, management slashed the fully franked interim dividend by 21% to 11 cents per share.

Commenting on the company's dividend payment and outlook on the day the results were announced, IGO CEO Ivan Vella said, "While we have faced some challenges in recent months, our business remains in a great position."

Vella added:

The declaration of an 11 cent per share interim dividend today, in line with our capital management framework, reflects our strong underlying free cash flow and robust balance sheet position.

Adding the interim dividend back into today's IGO share price, it would see the ASX 200 stock up 3.7%.

If you held shares at market close yesterday, you can expect to see the IGO dividend payout land in your bank account in two weeks, on 27 March.