With the market doing so well the past few months, you need to have your wits about you if you see any discounted ASX shares.

The reality is that stocks sink because there is good reason for it. The business might be declining or the external environment may be hostile.

To find the occasional gem, you may need a bit of assistance from people who spend all day looking for such treasures.

Here are two cheap shares currently in that position, which experts are tipping for a revival:

New boss could turn this ailing business around

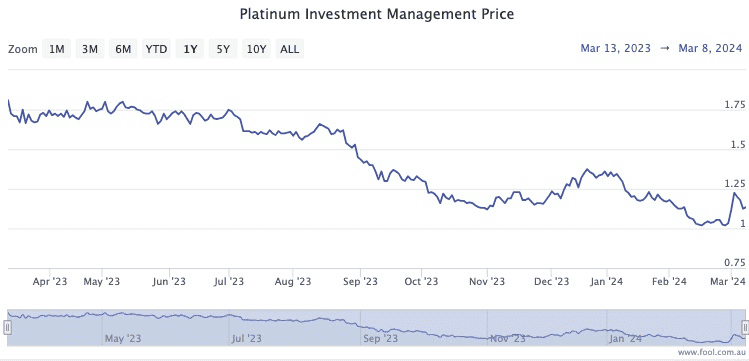

For an investment management firm whose fortunes are tied to the health of the market, the Platinum Asset Management Ltd (ASX: PTM) share price has been poor.

The stock has declined almost 35% since June 2023, and more than 16% so far this year.

Red Leaf Securities chief executive John Athanasiou rates the stock as a buy though.

"The investment manager recently appointed Jeff Peters as managing director, and the company has embarked on a turnaround strategy," Athanasiou told The Bull.

"An immediate priority is to reduce costs across the business while reviewing existing product offerings and distribution channels."

For those willing to give this one a go, a juicy 11.4% dividend yield is on offer.

"We believe Platinum Asset Management is primed for a recovery under new management."

It's fair to say this is a contrarian play from Athanasiou.

According to broking platform CMC Invest, none of the 12 analysts covering the stock recommend it as a buy.

Cheap shares with huge 'upside potential'

As a complete contrast, Silk Logistics Holdings Ltd (ASX: SLH) is rated a strong buy by all three analysts — Moelis Australia, Morgans and Shaw & Partners.

But it too is heavily discounted, to the tune of 41% since May.

The shares had a particularly brutal 16.2% drop in one day during reporting season.

Auburn Capital head of wealth management Jabin Hallihan was not at all disturbed by the half-year results.

"This integrated logistics provider generated revenue of $276.5 million in the first half of fiscal year 2024, an increase of 9% on the prior corresponding period."

The outlook is positive for the logistics provider.

"The company is forecasting revenue growth for the full year," said Hallihan.

"It has provided revenue guidance of between $540 million and $560 million provided there's no further adverse changes in economic conditions."

He added that Silk Logistics was at an advantageous point in its corporate journey.

"The company has completed the acquisition of port logistics business Secon, consolidating its position in the bulk logistics market amid generating a new revenue stream.

"The company is well managed. In my view, Silk Logistics is trading at a substantial discount for a company offering upside potential."