I've noticed in recent times that there's a particular stock that nosedived during reporting season, but many experts are still backing it.

So that might mean that a golden opportunity has opened up to buy some cheap ASX shares.

MA Financial Group Ltd (ASX: MAF) provides a wide range of financial services such as asset management, corporate advisory, and lending.

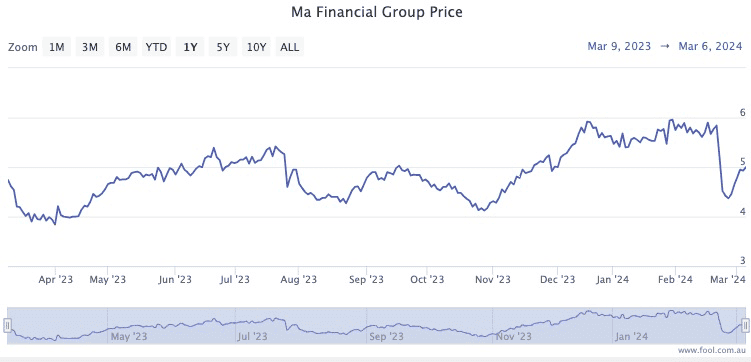

The share price, unfortunately, dived more than 20% on the day that its full-year results were revealed last month.

The stock still remains well below what it was most summer.

Let's explore what's going on here:

Spending money now to make money later

Glenmore portfolio manager Robert Gregory explained that the 2023 financial year numbers were about 8% below market expectations.

"FY23 EBITDA was $81.6 million (down -24%), whilst NPAT was $41.6 million (down -32%)," he said in a memo to clients.

"The result was impacted by MAF investing for growth in areas such as MA Money, the expansion of the Private Credit business in the US, and new distribution channels in Singapore."

Despite the savage market reaction to the result, there were bright spots.

"Management fees (which are largely recurring), increased +22% to $153 million.

"MAF said investments in various growth initiatives will continue into 2024 (which surprised the market), which will impact EPS by ~6 cents per share, albeit should benefit earnings from FY25 onwards."

And this is why so many professionals are, with a long-term horizon, bullish on MA Financial shares.

The 4% fully franked dividend yield also helps the argument that these are cheap ASX shares.

The analysts at Celeste Funds pointed out it's already pretty close to heading into the black and the year ahead looks positive.

"MA Money is forecast to breakeven in 2H24," they said in a memo to their clients.

"The Corporate Advisory & Equities business endured a difficult year but should rebound as capital markets reopen."

Broking platform CMC Invest is currently showing all three analysts surveyed as recommending MA Financial as a strong buy.