ASX uranium stock Nexgen Energy (Canada) CDI (ASX: NXG) may play a major part in the forecast significant growth of nuclear power. Leading fund manager L1 is a fan of this business, despite a recent dip in the price of the commodity.

Uranium prices fell back from 15-year highs recently following stronger-than-expected 2024 production guidance from a big player in the sector, Cameco, and potential US sanctions on Russian nuclear fuel exports not going ahead.

Why L1 is so excited by this ASX uranium stock

The fund manager believes the uranium market still has positive fundamental supply and demand tailwinds over the medium to long term.

NexGen is preparing to develop the world's largest uranium deposit, Arrow, located in the Saskatchewan region of Canada.

Once up and running, this resource would be a "major, new, strategic Western source" of supply that can address the anticipated market deficit.

L1 said Arrow had the potential to generate more than C$2 billion of cash flow annually at the current uranium spot prices. This was "highly attractive" due to NexGen's market capitalisation of C$5.8 billion.

In the company's base case, at $50 per pound of the resource, the company suggests it could make C$1.04 billion of average annual after-tax net cash flow. Under this situation, the company was expected to make an after-tax internal rate of return of 52.4%.

Latest update

The NexGen share price is sometimes affected by the progress updates that the ASX uranium stock reveals.

On 9 November 2023, the company announced it had received ministerial environmental assessment approval under The Environmental Assessment Act of Saskatchewan to proceed with the development of the project.

During 2023, NexGen further advanced the front-end engineering and design for the Rook I Project / Arrow deposit while continuing to progress the project through the critical path detailed engineering procurement phases.

NexGen share price snapshot

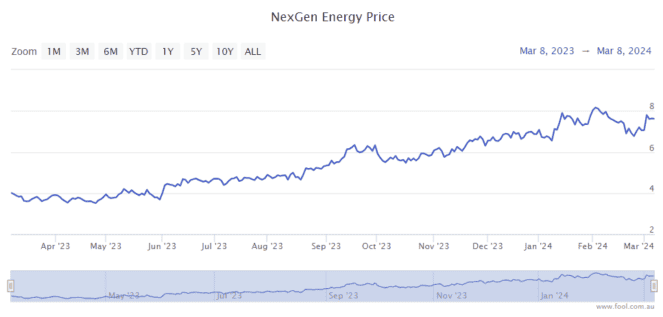

The NexGen share price has more than doubled in the past 12 months.