For many non-investors, and indeed novice ASX investors, the extraordinary power of compounding is hard to wrap their heads around.

As an example, they might see a 7% annual return on an investment and think that's nothing impressive.

But that level of compound annual growth rate (CAGR), kept up for 10 years, will see your money double.

This is amazing to many people.

Becoming an ASX investor is more important than 20% CAGR

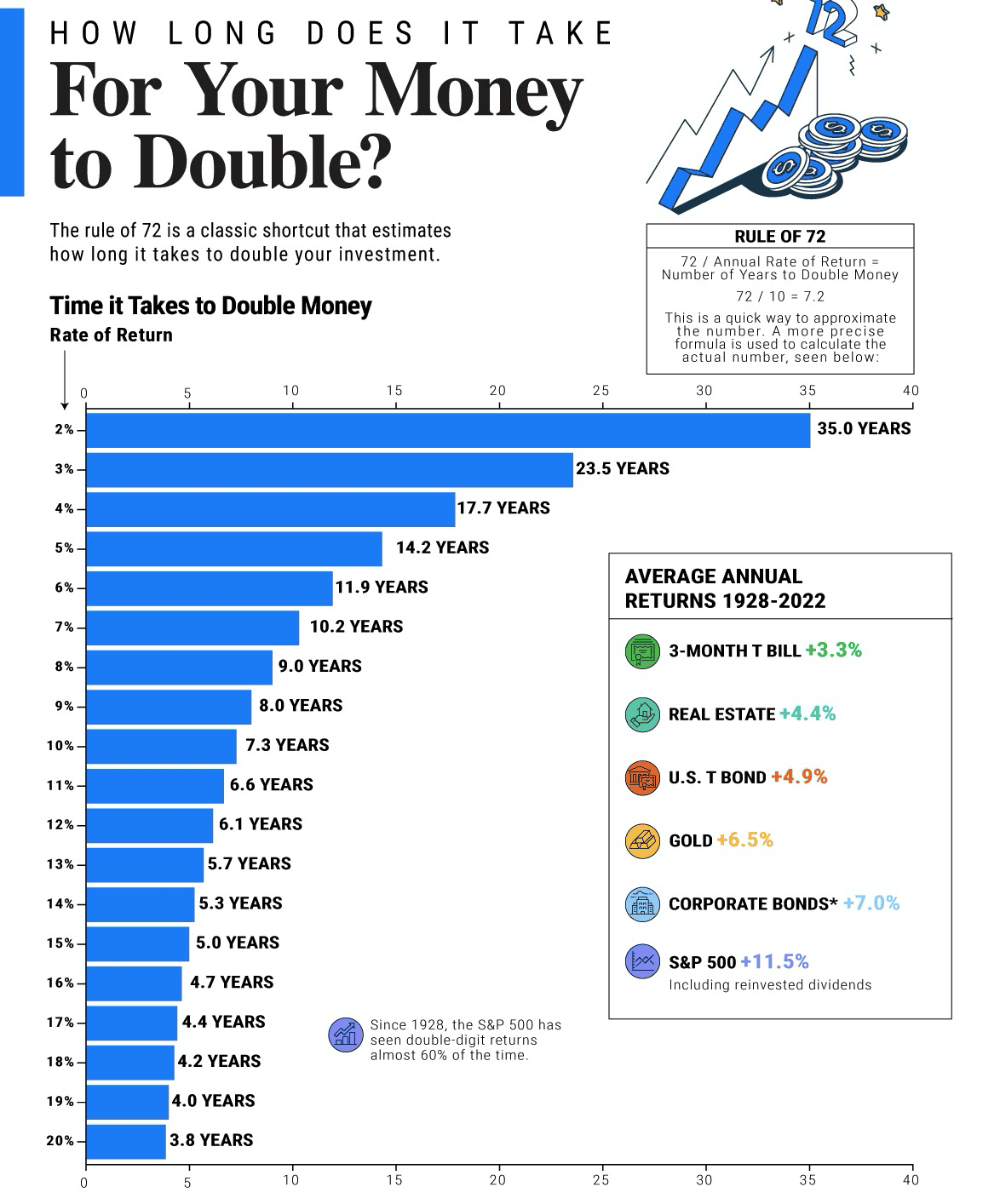

So to visually show off the incredible prowess of compounding, Visual Capitalist recently published a graphic that showed how long it takes for your money to double for various levels of CAGR:

The fascinating observation here is that each percentage point higher from 0% through to 7% makes a huge difference to how fast your investment will become twice the size.

Improvements in the CAGR beyond that don't make as large an impact.

For example, 15% CAGR will double your nest egg in five years. But it takes an unbelievable 19% annual return to reduce that down just to four years.

But if an ASX investor can improve the portfolio's performance from 2% to 6%, it cuts down the time from a whopping 35 years to 11.9 years.

It just goes to show that being invested is more critical than nabbing double-digit growth rates. Going from 0% to 7% has a far larger impact on your wealth than improving from 7% to 14%.

Do you want to wait 6.4 years or 120?

Visual Capitalist financial writer Dorothy Neufeld pointed out that this huge difference in the lower percentages is what makes stocks such an attractive investment in the long term.

"Consider if an investor put their money in the S&P 500 Index (SP: .INX). Historically, it has averaged 11.5% returns between 1928 and 2022. In 6.4 years, their money would double, assuming these average returns.

"If they were to put this money in a savings account, where the average savings rate is 0.6%, it would take 120 more years for their money to reach this potential."

She added that, if inflation is taken into account, money stored as cash actually shrinks in value.

"Historically, inflation has averaged 3.3% over the last century."