Goodman Group (ASX: GMG) is an ASX stalwart stock that has delivered impressive growth and continues to have a strong outlook.

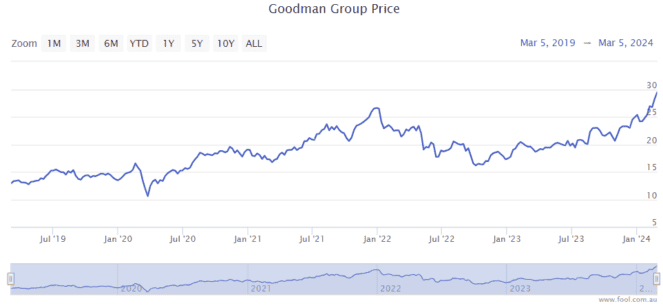

In the past year, the Goodman share price has risen 59% and it has risen over 130% in the last five years.

It describes itself as a global industrial property and digital infrastructure specialist group with operations across Australia, New Zealand, Asia, Europe, the UK, and the Americas. The business owns, develops and manages "high-quality sustainable properties" that are close to consumers in key cities around the world.

The property portfolio includes logistics and distribution centres, warehouses, light industrial, multi-storey industrial, business parks and data centres. It recently reported its FY24 half-year result, which I thought was impressive.

Continuing performance

The ASX stalwart stock is expecting to achieve FY24 full-year operating earnings per security (EPS) growth of 11%.

Businesses around the world need more, and increasingly advanced, logistics properties to fulfil their distribution network needs. Goodman owns some of the most impressive warehouses in Australia. Amazon is by far its biggest tenant by rental income.

The business has low gearing, of 9%. I think this puts it in a strong position in this high interest rate environment. Some property businesses have much higher debt levels, which is increasing their interest expenditure.

Its portfolio occupancy remains high at 98.4%, with like-for-like net property income (NPI) growth of 5%.

Strong outlook

Goodman said at its FY24 first-half result that significant progress has been made on advancing its data centre strategy, securing power and planning, commencing infrastructure and continuing to work with customers.

The business is "well-positioned to capture strong demand for new, high-value, high-tier data centre facilities in supply-constrained locations." Data centres are expected to be a key area of growth for the group.

Data centres have "attractive development margins on existing and new projects". Data centres under construction currently represent just over a third of the ASX stalwart stock's WIP.

It has total WIP of $12.9 billion, which covers 85 projects in 12 countries. The development yield on cost is 6.7% for projects in WIP. The weighted average lease expiry (WALE) is 13.6 years for the projects in WIP.

All of these completed projects will contribute significantly to Goodman's rental profits and operating EPS.

We can't control what the Goodman share price will do, but it's regularly reporting operating EPS growth of around 10% each year. Supply constraints in its locations are expected to continue to drive rental growth and maintain high occupancy rates across the portfolio.

It's not cheap, but I think it's one of the highest-quality ASX shares around. That's why I'd called it an ASX stalwart stock.