It's hard to believe we're two months into 2024 and have already put another earnings season to bed… but, here we are!

For investors, the new year has kicked off quite nicely, with the S&P/ASX 200 Index (ASX: XJO) already up a not-too-shabby 0.98%.

With the hope of keeping the positive returns flowing, we asked our Foolish writers which ASX shares look like top buying opportunities right now. Here is what the team came up with:

6 best ASX shares for March 2024 (smallest to largest)

- IPD Group Ltd (ASX: IPG), $506.56 million

- Global X Battery Tech & Lithium ETF (ASX: ACDC), $589.06 million

- Johns Lyng Group Ltd (ASX: JLG), $1.75 billion

- Flight Centre Travel Group Ltd (ASX: FLT), $4.70 billion

- Woolworths Group Ltd (ASX: WOW), $39.85 billion

- CSL Ltd (ASX: CSL), $138.28 billion

(Market capitalisations as of market close 29 February 2024).

Why our Foolish writers love these ASX stocks

IPD Group Ltd

What it does: IPD Group is an Australian electrical product distributor, serving the country's electrical equipment needs for more than 70 years. I tend to think of it as the Bunnings of specialised electrical products.

By Mitchell Lawler: There are arguably many demand drivers for electrical equipment in the years to come. Whether it is data centres, electric vehicle infrastructure, or construction growth to meet an increasing population – IPD Group is poised to soak up the expansion.

After many acquisitions, IPD is quickly becoming a one-stop shop for a diverse range of equipment, including power distribution, power monitoring, industrial motor control, and automation.

Importantly, the company has demonstrated solid growth in recent years. In the latest half, IPD delivered net profit after tax (NPAT) growth of 22.5% to $9.8 million.

The high insider ownership among management also gives me confidence that this team is committed to the company's long-term success.

Motley Fool contributor Mitchell Lawler does not own shares of IPD Group Ltd.

Global X Battery Tech & Lithium ETF

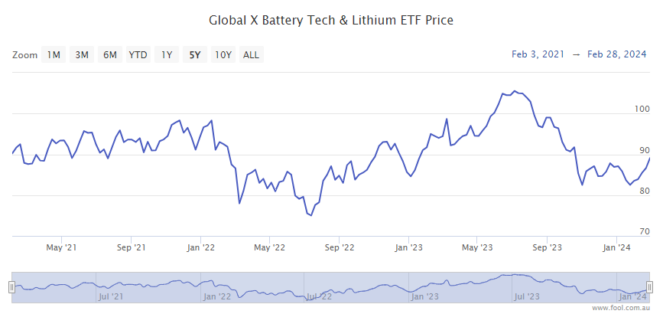

What it does: This exchange-traded fund (ETF) tracks the Solactive Battery Value-Chain Index, which contains stocks for companies involved in battery technology.

By Tony Yoo: Battery materials, especially lithium, have been in a painful funk for 15 months now. But investors could start looking at picking up shares for cheap with a view to the long-term demand for batteries from the electrification of fossil fuel-powered devices.

Rather than attempting to pick the wild fortunes of individual miners, this ETF provides diversification to invest in the industry as a whole. The transition to a less carbon-intensive future is real and, I believe, will be a long-running theme for years to come.

Motley Fool contributor Tony Yoo does not own units of the Global X Battery Tech & Lithium ETF.

Johns Lyng Group Ltd

What it does: The core service this ASX 200 company provides is restoring buildings and contents after an insured event, such as a fire, storm, or flooding. It also has increasing capabilities and exposure related to catastrophe work.

By Tristan Harrison: The Johns Lyng share price dipped after the company reported its FY24 first-half result. While catastrophe revenue may not have been as strong as some investors wished, it's not the sort of work that is going to grow consistently year after year – I expect it to be lumpy. And, short-term declines can present opportunities.

Johns Lyng's 'business as usual' (BAU) revenue rose 13.7% to $426.1 million, and its normalised NPAT grew by 15.8% to $25 million, demonstrating operating leverage within the business. Plus, it upgraded revenue guidance for FY24 by 3.5%.

Furthermore, I'm excited by the company's expansion in the strata industry. Acquiring strata managers can result in more consistent (and growing) revenue and also create synergies with the core business.

I am planning to buy more Johns Lyng shares soon.

Motley Fool contributor Tristan Harrison owns shares of Johns Lyng Group Ltd.

Flight Centre Travel Group Ltd

What it does: The ASX 200 company is one of the world's largest travel agency groups. Flight Centre operates in more than 23 countries, with a corporate travel management network that spans more than 90 countries.

By Bernd Struben: I believe the Flight Centre share price remains materially undervalued over the longer term.

Given the company's earnings and revenue growth, not to mention its return to profitability, I think it has the potential to eventually retrace to pre-COVID levels of more than $40 a share. That essential doubling in the share price won't come overnight. But the company is certainly moving in the right direction.

For its half-year results, Flight Centre achieved NPAT of $86 million, up from a net loss of $20 million in 1H FY23. The company also reported a 99% increase in underlying earnings before interest, tax, depreciation and amortisation (EBITDA) of $189 million.

And we saw the return of the interim dividend, which followed on from the reinstatement of the final dividend in September. Flight Centre trades on a fully-franked trailing yield of 1.4%.

Motley Fool contributor Bernd Struben does not own shares of Flight Centre Travel Group Ltd.

Woolworths Group Ltd

What it does: Woolworths is Australia's largest supermarket operator. It also owns the Big W brand and has a growing presence in the pet care market.

By James Mickleboro: With the company's shares trading within sight of a 52-week low, I think now is a great time to invest in this high-quality company. Particularly given its leadership position in a defensive market with high barriers to entry.

In addition, recent weakness in the Woolworths share price means it offers an attractive dividend yield in the region of 3.2%.

Goldman Sachs remains very positive on the company. So much so that it has Woolworths shares on its coveted conviction list with a buy rating and $40.40 price target.

Motley Fool contributor James Mickleboro does not own shares of Woolworths Group Ltd.

CSL Ltd

What it does: CSL is the largest healthcare company in Australia. It has an extensive global plasma collections operation, as well as a world-leading vaccine and blood medicine division.

By Sebastian Bowen: CSL shares have had a rough time of late. Even though the company reported a very solid earnings report this month, investors still haven't forgiven CSL for its disappointing heart attack drug trial.

I think this presents an opportunity for CSL shares this March, though. The company is still growing at a healthy pace and has recently hiked its dividend by 12%.

CSL's plasma collections business remains lucrative and should underpin earnings growth for years to come. I think you could do a lot worse than CSL shares at the recent pricing.

Motley Fool contributor Sebastian Bowen owns shares of CSL Ltd.