Savvy investors know that it's time to pounce on ASX growth shares when the market is temporarily spooked despite the business remaining rock solid.

The startling fact is that the stock market is more emotional than it cares to admit, and often reacts harshly to short-term factors.

In this reporting season, I think Johns Lyng Group Ltd (ASX: JLG) is precisely in this situation.

The company presented its results on Tuesday morning, sending its share price plunging 20% in the first few minutes of trade.

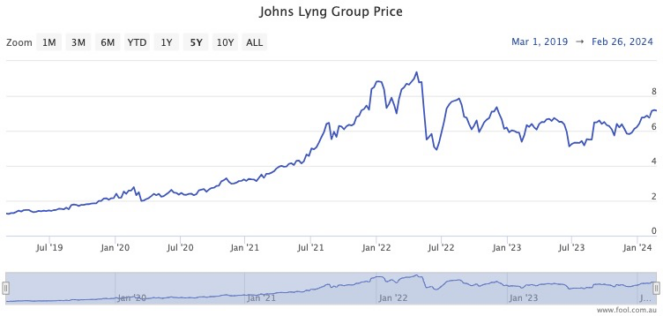

That chaos has now nudged the total loss for Johns Lyng investors since April 2022 above the 30% mark.

Profit, earnings down after reporting season

The main culprit for this week's panic seems to be a reduction in the half-year net profit after tax (NPAT).

Johns Lyng reported $31.1 million on Tuesday, as opposed to the $34.1 million for the first half of the 2023 financial year.

And that predictably led to a decrease in earnings per share (EPS), from 9.68 cents to 8.47 cents.

Perhaps Johns Lyng is a victim of its own past success here, as the stock has risen more than 400% in the past half-decade.

Expectations are high when a business grows that quickly, so the market dealt with this setback harshly.

But is Johns Lyng terminal?

Looking under the hood, the numbers were not convincingly indicative of a business in chronic decline.

"Johns Lyng said it had a record volume of Business as Usual (BaU) work during the quarter. This resulted in $426.1 million in revenue, up 13.7% on 1H FY23," reported The Motley Fool's Bronwyn Allen.

As much of Johns Lyng's activities are related to natural disasters, the work can fluctuate over time.

Revenue from the catastrophe (CAT) business did come in 35% lower compared to a record-breaking 1H FY23, when much of eastern Australia was suffering from heavy rains.

But management pointed out $120.4 million of CAT revenue collected this time is already 87% of the previous full-year forecast.

"This has led to an upgraded full-year revenue forecast of $177.8 million."

The pros are sticking with the growth stock

A critical barometer for any investors considering swooping on Johns Lyng shares while they're cheap is what the professionals think after the half-year numbers.

And it's notable that none of the major broking houses have changed their ratings or target share price for Johns Lyng since Tuesday morning.

According to CMC Invest, five of seven analysts still believe the stock is a strong buy.

So for those willing to stick with it for the long run, this week could be an ideal opportunity to buy Johns Lyng at a discount.