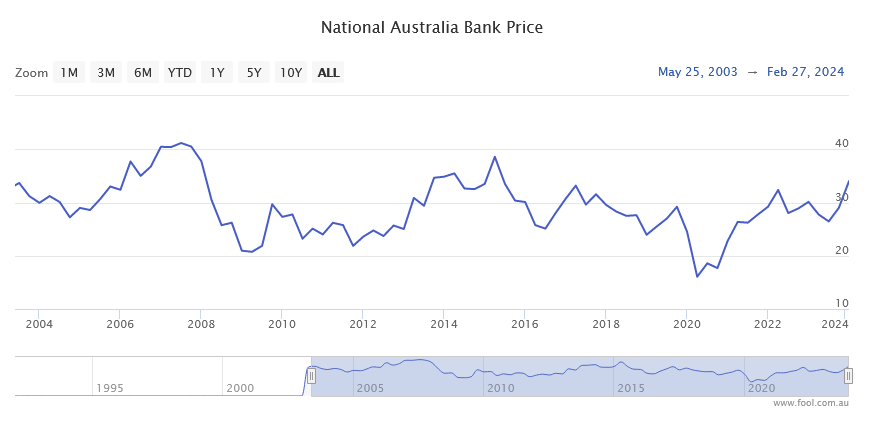

Last week, we covered the brand new 52-week high for the National Australia Bank Ltd (ASX: NAB) share price. At that time, NAB shares hit a new high watermark of $33.85 each.

Since then, NAB has gone on to hit yet another new 52-week high. Just yesterday, we saw the bank climb up to a new top of $34.18.

This is fairly momentous for NAB shareholders. After all, the ASX 200 bank share has now gained 10.3% in 2024 alone so far, as well as more than 35% since June last year.

But, even though this is the highest level NAB has climbed to in well over five years, it's still not a new all-time high for this big four bank.

If you think NAB last hit an all-time high back in early 2015, you'd be forgiven. Back then, prior to NAB's Clydesdale sale, NAB shares got as high as $37.78. That's a good 10.7% away from that 2015 high.

But alas, we still haven't arrived at the NAB share price's all-time high.

To find this elusive figure, we have to journey all the way back, past the elections of Kevin Rudd and Barack Obama, to 2007. In November 2007, the NAB share price clocked a record high of $42.66 a share.

That's around 26% off of yesterday's new 52-week high. And it occurred more than 16 years ago.

Check it out for yourself below:

Will the NAB share price ever get back to $42?

It's hard to say whether the NAB share price will ever get back to $42.66. The pre-global financial crisis world of 2007 was a very different place. Online banking was only just taking off, cheques and passbooks were the norm, and paying by 'tap' was years away.

The Australian banking scene of the mid-2000s was dominated by wild ventures into untapped markets that subsequently ended in failure. NAB was one of the worst banks to be hit by this trend in Australian banking.

It used to have an American subsidiary called Great Western Bank, as well as its UK holding Clydesdale. Both ventures have subsequently been sold out (although Clydesdale remains on the ASX in its current Virgin Money UK plc (ASX: VUK) form).

It was arguably these foreign ventures, amongst many other factors, that destroyed much of NAB's market capitalisation in the years following 2007.

NAB shares have had a long but steady road back to where it stands today. At least investors have had the bank's generous dividends to keep them warm during these hot and cold years of the past two decades.