The Aussie Broadband Ltd (ASX: ABB) share price is up 1.4% at $4.60 this morning after the company announced a takeover bid for Superloop Ltd (ASX: SLC). In addition, it has acquired a 19.9% interest in Superloop.

Offer details

This bid is a non-binding indicative proposal to buy the whole of Superloop.

If accepted, Superloop shareholders would get 0.21 Aussie Broadband shares for each Superloop share they own. When Aussie Broadband made its bid, that value implied was 95 cents per share,. This was based on the closing Aussie Broadband share price of $4.53 on 23 February 2024.

Based on the Superloop share price of 88 cents on 23 February 2024, the offer premium was 8%.

Aside from the value on offer, why would Superloop shareholders want to accept? Aussie Broadband said through ongoing ownership in Aussie Broadband, there would be participation in the future value creation of the combined business including through synergies over time.

What are the benefits to owners of Aussie Broadband shares?

The company pointed to four key elements it considered compelling reasons for the deal.

It would make Aussie Broadband a larger player in Australia, providing broadband access services for more than 1 million subscribers, with "greater reach and network infrastructure" through three brands – Aussie Broadband, Superloop and Exetel.

The combined business would have a growing business segment with an enhanced product offering and end-to-end capabilities to compete with existing sizeable players.

A merged business would have a "strong" wholesale offering that was "well-positioned" for growth through improved scale and investment.

Finally, Aussie Broadband said a number of synergies could be achieved with network cost duplication and other normal cost areas.

Not agreed yet

The takeover hasn't been agreed, but Aussie Broadband has bought a 19.9% interest in Superloop at a cost of 95 cents per share.

The companies would first need to tick off several conditions, including the need for Aussie Broadband to complete satisfactory confirmatory due diligence. The two ASX telco shares must enter into a scheme implementation deed, and the Superloop board must make a unanimous recommendation.

Superloop will presumably respond in due course.

Aussie Broadband noted there was no certainty the proposal would result in a transaction.

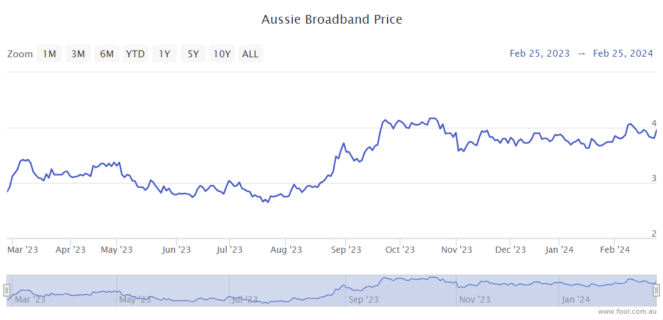

Aussie Broadband share price snapshot

Over the past year, the Aussie Broadband share price has risen by more than 50%. There was a strong positive reaction to its recent result.