The Medibank Private Ltd (ASX: MPL) share price is under pressure after releasing its latest results this morning.

At the time of writing, shares in the health insurer are down 5.3% to $3.66. The downward move makes it the worst-performing company in the financials sector on Thursday.

Medibank share price scrapes its knee on 'competitive market'

- Group revenue up 3.3% to $4,024 million

- Net investment income up 49.6% to $83.6 million

- Net profit after tax (NPAT) up 104.8% to $491.9 million

- Underlying NPAT up 16.3% to $262.5 million

- Interim fully franked dividend of 7.2 cents per share, up 14.3% from 6.3 cents

Importantly, the doubling of statutory NPAT is heavily influenced by a change in accounting standards. The adoption of AASB 17 means first-half profits were boosted by $80.7 million due to how COVID-19 claim savings and givebacks had to be recognised.

What happened in the first half?

In the six months ending 31 December 2023, Medibank's resident health insurance segment remained resilient. The company marginally grew its resident policyholders by 3,400 or 0.2% during the half. This was restrained by a competitive market, leading to a 'modest increase' in customers switching funds.

The non-residents (overseas visitors and students) segment fared much better in the half. Medibank achieved a net increase in non-resident policyholders of 33,800 or 12.3%.

On the investment side of the business, it is clear Medibank is benefitting from the hoisted interest rates. Income sourced from the company's investments jumped 49.6% versus the prior corresponding period to $83.6 million.

Medibank expensed $17.6 million in non-recurring cybercrime costs during the half. Management anticipates an additional $30 million to $35 million will be spent in FY24 to improve its IT security further and cover regulatory/litigation costs associated with the hack in October 2022.

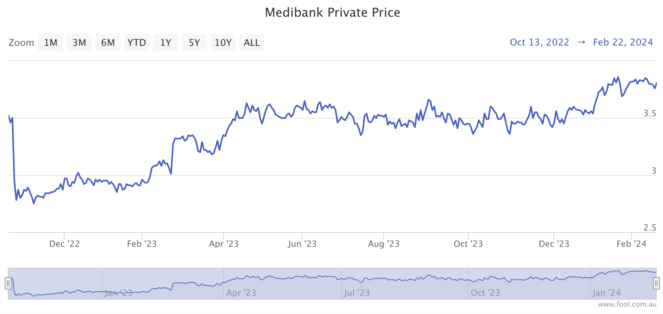

The Medibank share price is up approximately 5% since the cyber incident was originally disclosed, as shown below.

What did management say?

Medibank CEO David Kockzkar emphasised the company's pursuit of a health-first transition, stating:

The health transition is underway. From overnight stays in expensive acute care hospitals to virtual, short stay and home care. From treatment to prevention and from general care to personalised health.

We have been at the forefront of this transition by making targeted investments in growing health markets to better support our customers and improve the way healthcare is delivered in Australia.

Our new partnership with healthcare technology group Amwell will enable us to deliver virtual prevention programs at scale.

The Amwell partnership hit the grapevine earlier this week. As part of the coalition, Medibank will implement Amwell's technology to promote wellness and prevent chronic disease.

What's next for Medibank Private?

No specifics were provided about revenue or profits in today's release. However, shareholders were supplied with some guidance on policyholder growth and resident claims, as follows:

- 1.2% to 1.5% resident policyholder growth expected in FY24

- 2.2% to 2.4% expected claims per policy unit growth (down from 2.6%)

Furthermore, organic and inorganic growth for Medibank Health and Health Insurance segments were named 'areas of focus'.

Medibank share price snapshot

Shares in Medibank have performed solidly over the last year, beating out many of its S&P/ASX 200 Index (ASX: XJO) included peers, rallying 21.4%. The rise in value gives the 48-year-old insurance company a market capitalisation of $10.2 billion.

Medibank trades on a price-to-earnings (P/E) ratio of roughly 20 times earnings. This is on par with its ASX-listed peer NIB Holdings Limited (ASX: NHF). However, it does suggest that Medibank's share price trades at a premium to the global insurance industry (12 times earnings).