The IGO Ltd (ASX: IGO) share price is rising today following the release of its FY24 first-half results.

Shares in the lithium and nickel producer are changing hands at $7.23, up 2.3%, as we head into the afternoon. In contrast, the ASX materials sector is only slightly ahead by 0.2% amid flat performances from some of the bigger businesses.

IGO share price shakes off deep earnings wound

- Revenue down 19% to $438 million

- Underlying EBITDA down 39% to $515 million

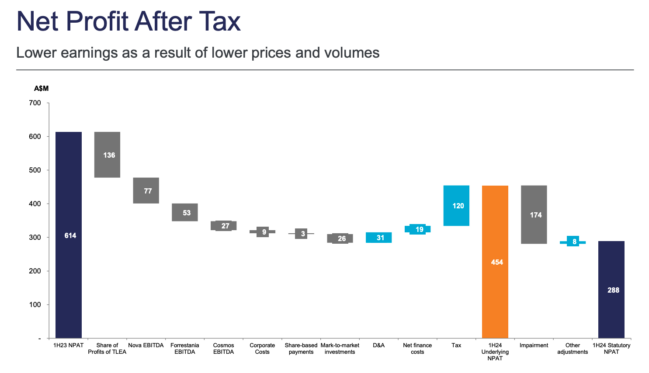

- Net profit after tax (NPAT) down 53% to $288 million

- Interim fully franked dividend of 11 cents per share, down 21%

- Net cash at the end of the half of $276 million, down 33%

In addition to the above, IGO reported a 4% increase in spodumene production to 771,000 tonnes in the half. Similarly, lithium hydroxide production leapt 57% to 1,224 tonnes. Despite the increase in volume, spodumene costs escalated 36% to A$306 per tonne.

What went on during the half?

A decline in commodity prices severely affected IGO's figures compared to last year's first-half result. The reduced spodumene price and sales volumes within its joint lithium venture, Tianqi Lithium Energy Australia, shrunk its share of profits from $631.4 million to $495.2 million.

Adding more margin pressure, the Australian miner experienced rising costs as the scale benefits unwinded with reduced production. For instance, cash costs per pound of nickel at the Nova operation rose from $3.99 to $4.18. Likewise, the Forrestania operation saw its per-pound nickel costs increase to $11.83.

As pictured above, a hefty impairment charge has also put a dent in IGO's half-year result. According to the release, the $171.8 million impairment relates to its Cosmos and Forrestania assets as a result of the decline in nickel prices.

On 13 December 2023, IGO said it would transition the Cosmos project to an ore trucking operation while it concluded its review. Last month, it was decided to place the project into care and maintenance. The IGO share price was mostly flat between these two updates, as shown in the chart below.

What did management say?

Steering away from the bleak set of numbers, IGO managing director and CEO Ivan Vella painted an optimistic view of the company:

While we have faced some challenges in recent months, our business remains in a great position. The declaration of an 11c per share interim dividend today, in line with our capital management framework, reflects our strong underlying free cash flow and robust balance sheet position.

Going on to say:

This strength, combined with our asset portfolio, highly credentialled partners, and unique, purpose-led culture gives me great confidence in what IGO can achieve in the future.

The road ahead

Forecasts for the full year of FY24 indicate continued weakness in commodities. Some of the key points from IGO's revised guidance are as follows:

- Total nickel production of 28,500 to 31,000 tonnes (narrowed from 29,000 to 32,500 tonnes)

- Nickel cash costs of $5.75 to $6.50 per pound (up from $5.00 to $5.75)

- Spodumene production of 1,300 to 1,400 tonnes (down from 1,400 to 1,500 tonnes)

- Lithium cash costs of $330 to $380 per tonne (up from $280 to $330 per tonne)

The lower spodumene production guidance stems from the mine operator's "need to manage production and stockpiles following a reduction in sales", according to the report.

The IGO share price is down 45% over the past 12 months.