The Rio Tinto Ltd (ASX: RIO) dividend was declared yesterday after the ASX had closed, along with the company's FY23 results. The dividend is the final payment of FY23.

Rio Tinto dividend

The ASX mining share declared a final dividend of A$3.9278 per share, fully franked. This was an increase of around 20% compared to last year.

However, in US dollar terms, the final dividend of US$2.58 only increased by 14.7% year over year.

The dividend is determined in US dollars but paid to Aussies in Australian dollars.

This final dividend brought the full-year dividend to A$6.5367, which was a reduction of 8% compared to FY22. In US dollar terms, it's a full-year payment of US$4.35 (reduced by 11.6%).

How much profit is Rio Tinto going to pay out?

The ASX mining share said the dividend payout ratio is used to decide how much it pays out. Rio Tinto aims to pay 40% to 60% of underlying earnings to shareholders as dividends on average through the cycle.

Rio Tinto has decided to payout 60% of its underlying earnings – it generated underlying earnings per share (EPS) of US$7.25 (which was down 12%).

The reported net profit after tax (NPAT) fell 19% to US$10 billion and free cash flow declined 15% to US$7.66 billion.

Rio Tinto was pleased to say that its balance sheet strength enables it to continue to invest with discipline while also paying the total dividend amounting to US$7.1 billion.

Ex-dividend date

To gain entitlement to the dividend, investors need to make sure they own Rio Tinto shares before the ex-dividend date.

The ex-dividend date is 7 March 2024, so investors have until the end of trading on 6 March 2024.

This dividend is going to be paid on 18 April 2024, so investors will need to wait just over a month.

Management comments

Rio Tinto chief executive Jakob Stausholm said:

We will continue paying attractive dividends and investing in the long-term strength of our business as we grow in the materials needed for a decarbonising world.

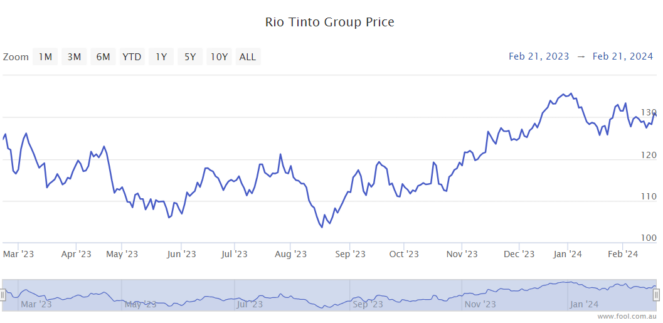

Rio Tinto share price snapshot

Over the past year, Rio Tinto shares are virtually flat compared to a year ago.