The CSR Ltd (ASX: CSR) share price jumped 17% before entering a trading halt on a potential takeover deal.

CSR is one of Australia's biggest building product companies, with products like Gyprock plasterboard, Bradford insulation, Cemintel fibre cement, Hebel autoclaved aerated concrete panels, PGH Bricks, Monier roof tiles and AFS walling systems.

Takeover talk

According to reporting by The Australian, CSR shares have entered a trading halt following reports by Bloomberg that French business Saint-Gobain is thinking about a possible deal to buy CSR. They have reportedly held initial talks.

CSR shares climbed 17.4% to $7.95 before the trading was paused.

The French business is a giant in the industry and has the scale to afford the deal. It made €51.2 billion in revenue in 2022 and has 168,000 employees across 75 countries. It can trace its history back to 1665 from the creation of the Manufactory of Mirror Glass – it has been operating for over 350 years.

Is CSR a tempting target?

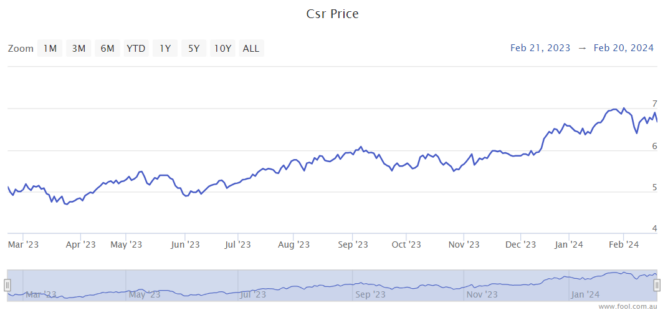

It's an interesting time to be considering an acquisition considering the CSR share price was, before today, close to its multi-year high. It hasn't been at this current level since the GFC.

CSR is looking at uncertainty in the short term amid all of the inflation, interest rate rises and increased insolvencies in the construction industry.

Nonetheless, the FY24 half-year result showed solid profitability, with underlying net profit after tax (NPAT) of $94 million, down 15% year over year. Strong growth in the building products division was offset by a lower contribution from property and aluminium.

For its outlook, it said there was still a good pipeline of work for the building products division. However, the aluminium business is forecast to see a loss in the range of between $15 million to $30 million. It also recently announced settlement of stages 3A and 3B of Horsley Park, the location of its former brick plant.

CSR share price snapshot

In the past year, the CSR share price has climbed over 60%, including today's gain.