It's been an eventful February earnings season thus far. We've seen some stellar results and supersized share price gains from ASX consumer shares like Cettire Ltd (ASX: CTT), Nick Scali Limited (ASX: NCK), Temple & Webster Group Ltd (ASX: TPW), and IDP Education Ltd (ASX: IEL).

ASX 300 tech stock Audinate Group Ltd (ASX: AD8) also delivered good news for investors, with its share price rocketing more than 20% on Monday this week following a record half.

On the dividend front, there have been some healthy boosts to shareholder payouts from the industrial sector, with Transurban Group (ASX: TCL) and Computershare Ltd (ASX: CPU) upping their interim dividends by 13% and 33%, respectively.

ASX blue-chip stocks and investor favourites CSL Ltd (ASX: CSL), Wesfarmers Ltd (ASX: WES), and Telstra Group Ltd (ASX: TLS) also rewarded investors with dividend hikes, although the resulting impact on their share prices was mixed.

Elsewhere in the big end of town, Commonwealth Bank of Australia (ASX: CBA) shares took a tumble on Wednesday this week after the ASX big four bank reported a 3% profit dip.

Despite plenty of reporting action still to come, including from the big ASX miners, there has been a great deal for investors to chew on so far.

On that note, we asked our Foolish writers which ASX stock they'd buy if they could choose only one so far this earnings season. Here is what they told us:

6 ASX shares to run the ruler over right now (smallest to largest)

- Camplify Holdings Ltd (ASX: CHL), $169.46 million

- Pacific Current Group Ltd (ASX: PAC), $545.13 million

- Temple & Webster Group Ltd (ASX: TPW), $1.43 billion

- Sonic Healthcare Ltd (ASX: SHL), $15.25 billion

- Wesfarmers Ltd (ASX: WES), $71.40 billion

- CSL Ltd (ASX: CSL), $137.20 billion

(Market capitalisations as at 16 February 2024).

Why our Foolish writers rate these ASX companies

Camplify Holdings Ltd

What it does: Camplify is an online platform for owners of recreational vehicles to hire them out to other users.

By Tony Yoo: Camplify is best described as an AirBnb-type app for caravans and motorhomes. It allows owners to hire their recreational vehicles out on a peer-to-peer platform, to provide an income when they're not in use.

From humble beginnings in Australia, the company has now expanded — via acquisitions and organic growth — to New Zealand, the United Kingdom, Spain, Germany, Netherlands and Austria.

While analyst coverage is sparse for the $175 million small cap, the stock has rewarded investors in recent times with a 35% climb since last April. It's no wonder, with 2023 financial year revenue 133% up from the prior period.

Camplify is due to release its interim financial report on 21 February.

Motley Fool contributor Tony Yoo owns shares of Camplify Holdings Ltd.

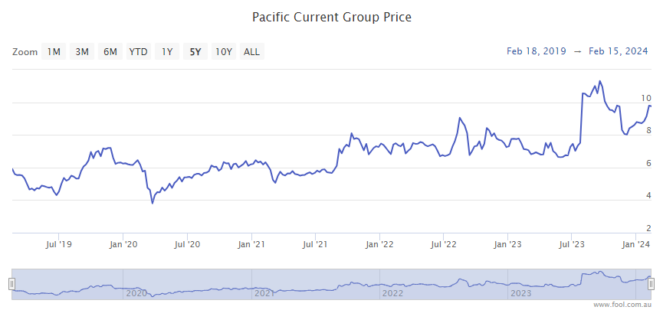

Pacific Current Group Ltd

What it does: Pacific Current invests in fund managers and helps them grow their businesses with its capital and expertise.

By Tristan Harrison: This ASX company's biggest asset is a position in fund manager GQG Partners Inc (ASX: GQG). The GQG share price and funds under management (FUM) have soared in the last few months, but the market hasn't been as excited about Pacific Current.

We've heard that many of Pacific's other fund managers are also performing well — experiencing inflows and winning new commitments for more investment. Plus, markets and asset prices have soared in the last few months, providing a strong tailwind for further FUM growth and perhaps encouraging more potential new clients.

I think Pacific's outlook is stronger than the market is giving it credit for, and the company's dividend outlook also looks promising.

Pacific Current is due to release its FY24 first-half result on Friday, 23 February.

Motley Fool contributor Tristan Harrison does not own shares of Pacific Current Group Ltd.

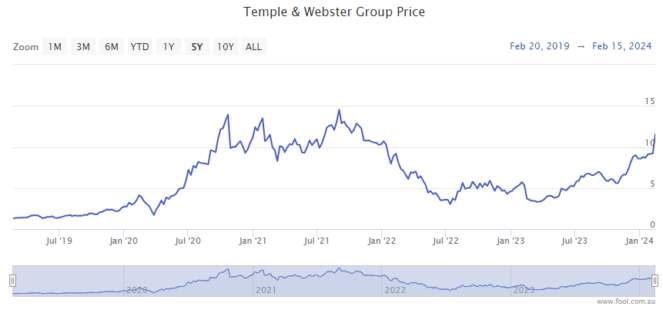

Temple & Webster Group Ltd

What it does: Temple & Webster is Australia's top online-only furniture and homewares retailer. The company offers more than 200,000 products that customers can buy 24 hours a day, seven days a week.

By Bernd Struben: Temple & Webster's online platform has delivered sales growth throughout the year despite the high inflationary and interest rate environment.

For the half year to 31 December, the company reported record revenue of $254 million, up 23% year on year. And I like the balance sheet, with cash holdings of $114 million and no debt.

As of Friday's close, the Temple & Webster share price is up 221% in 12 months at $11.63 cents. And I'm in agreement with Citi's analysts who believe there's more outperformance ahead. The broker has a target price of $13 a share on the stock, representing a potential upside of 12% from current levels.

Motley Fool contributor Bernd Struben does not own shares of Temple & Webster Group Ltd.

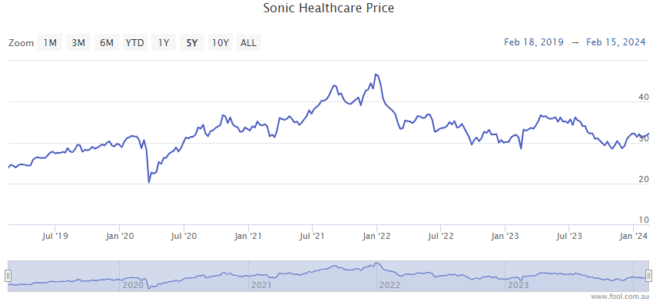

Sonic Healthcare Ltd

What it does: Sonic Healthcare is a private pathology and laboratory service provider with operations worldwide, including in Australia, the United States, Germany, the United Kingdom, and Switzerland. Sonic and its subsidiaries are often involved when a test or scan needs to be carried out and analysed.

By Mitchell Lawler: I believe Sonic Healthcare is among the highest-quality businesses on the Australian Securities Exchange due to its services' non-discretionary nature and defendable moat.

It requires an incredible amount of money to reach an efficient scale in pathology services. As a result, competitors are unlikely to risk billions of dollars to carve off a slither of market share. Sonic has used this to its advantage over the years by acquiring its way into market dominance across multiple geographies.

Additionally, I suspect Sonic might surprise the market on Tuesday, 20 February, when it releases its half-year results.

The company's last two reports have cycled large contributions from COVID-19 testing. However, having only constituted 6% of total revenue in FY23, the stage might now be set for a solid result unobstructed by the dwindling segment.

Motley Fool contributor Mitchell Lawler owns shares of Sonic Healthcare Ltd.

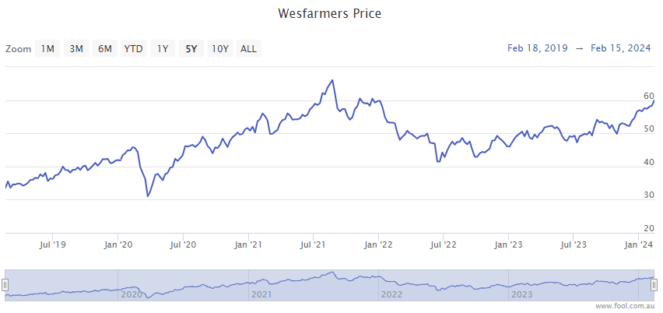

Wesfarmers Ltd

What it does: Wesfarmers is one of the most dominant companies on the ASX. It owns a huge array of different retail and industrial businesses under its name, the most prominent of which include Bunnings, Kmart, Officeworks, and Target.

By Sebastian Bowen: Wesfarmers is a holding that I've been hoping to add to for a while now and just might after the company's latest earnings. I was very happy to see Wesfarmers report higher revenues, earnings, profits and dividends for the six months ending 31 December.

Given the rising cost of living and stubborn interest rates, I think this is a great result for a company that would traditionally be described as cyclical and discretionary.

As such, I would be happy to buy Wesfarmers shares if I had to choose just one company this earnings season. It's quality is on display for all to see.

Motley Fool contributor Sebastian Bowen owns shares of Wesfarmers Ltd.

CSL Ltd

What it does: CSL is one of the world's leading biotechnology companies and the name behind the CSL Behring, Seqirus, and CSL Vifor businesses.

By James Mickleboro: I think CSL delivered a strong half-year result this week. And were it not for the failure of the CS112 product key trial a day earlier, I think the market would have reacted very positively.

As a reminder, CSL reported an 11% increase in revenue to US$8.05 billion and a 13% jump in net profit after tax before amortisation (NPATA) to $2.06 billion. The latter was ahead of the market's expectations.

In addition, management reiterated its guidance for NPATA growth of 13% to 17% for the full year and its belief that CSL "is in a strong position to deliver annualised double-digit earnings growth over the medium term."

I'm confident that management will deliver on this even without CSL112, making CSL shares a very attractive proposition for investors, especially following this week's pullback.

Motley Fool contributor James Mickleboro owns shares of CSL Ltd.