One million.

It's just a number, but there's something magic about seven figures that fascinates people.

If you'd like to one day have a million dollars in the bank, I'm here to tell you it's possible with S&P/ASX 200 Index (ASX: XJO) shares.

You don't have to be outrageously wealthy to start with. You just need discipline and a standard day job to make it happen.

Let me take you through one possible scenario:

Invest your savings now into the ASX 200

Comparison site Finder last year found the average Australian has $40,000 saved up.

So let's say you build yourself a stock portfolio with that.

Of course, at The Motley Fool we always urge investors to diversify their holdings to spread out the risk.

But other than that, go for the style that you find comfortable. Growth or dividend shares, it doesn't matter.

Either way, over the long term, I reckon you could aim to secure a 12% compound annual growth rate (CAGR).

Does that sound like a dream?

Check this out.

Over the past five years, quality ASX 200 names like Lovisa Holdings Ltd (ASX: LOV) and Altium Ltd (ASX: ALU) have managed to nab CAGRs of 25.3% and 19.4% respectively.

It's not like these are risky startups. They are established businesses among the top 200 largest public companies in the country.

Of course, I'm not saying every stock in your portfolio will do as well as Lovisa and Altium.

But with proper diversification, there might be a few of those winners mixed in with others that don't as well — and the whole lot could realistically perform at 12% growth each year.

Can you save regularly?

Now, what about that discipline I mentioned before?

That's needed to save regularly and keep adding to the portfolio.

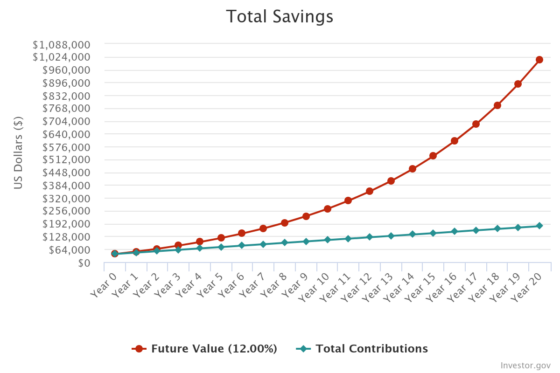

A $40,000 parcel of shares growing at 12% each year with a further $580 invested each month could take you to seven figures in pretty reasonable time.

If the returns are compounded monthly, after 20 years that portfolio would be worth $1,009,470.

There's your million!

So if you start this at age 25, you could be retiring as a millionaire by the time you're just 45.

Even if you begin your stock investing journey at 40, you'd end up with a mill way before the legislated retirement age.

Best wishes for your investments.