Two leading S&P/ASX 200 Index (ASX: XJO) real estate shares are shaking off concerns of lingering high interest rates and charging higher today.

The property stocks in question are Goodman Group (ASX: GMG), Australia's largest real estate investment trust (REIT), and shopping centre REIT Vicinity Centres (ASX: VCX).

Both ASX 200 real estate shares released their half year earnings results today (H1 FY 2024).

Read on for the highlights.

ASX 200 real estate share soaring higher on operating profit boost

First, we turn to Goodman's results for the six months ending 31 December.

Goodman reported:

- A 29% year on year increase in operating profit to $1.13 billion

- A statutory loss of $220 million

- Available liquidity of $3.0 billion

- An interim unfranked dividend of 15 cents per share, in line with H1 FY 2023

Also likely helping boost the ASX 200 real estate share today is its 98.4% reported portfolio occupancy, along with 5% like-for-like net property income (NPI) growth.

On the growth front, Goodman has $12.9 billion of development work in progress, spanning 85 projects with a forecast yield on cost of 6.7%. Data centres make up 37% of the company's development pipeline.

Commenting on the results boosting the ASX 200 real estate company today, CEO Greg Goodman said, "As the digital economy expands with the growth of artificial intelligence and increased computing requirements, so does our ability to provide the essential infrastructure needed to support its progress."

Goodman added:

Our portfolio of strategically located logistics properties provides customers the opportunity to increase investments in digitisation and automation to improve efficiency.

Our growth in data centre capacity underscores our ability to deliver digital infrastructure, where we're securing power on our sites and developing data centres in cities with high demand.

The Goodman share price is up 5.5% in early afternoon trade, at $28.05 a share. That sees the REIT's share price up 41% over 12 months, not including those dividend payments.

Vicinity Centres achieves 99.1% occupancy

Which brings us to Vicinity Centres, the second ASX 200 real estate share that's gaining on the back of its half year results.

Vicinity Centres reported:

- Statutory net profit after tax (NPAT) of $223.5 million, up 27% from H1 FY 2023

- Headline funds from operations ('FFO') of $345.6 million, down 3.2% year on year

- Occupancy increased to 99.1%

- Interim unfranked dividend of 5.85 cents per share, in line with last year

Commenting on the results helping boost the ASX 200 real estate stock today, CEO Peter Huddle said: "Our operating and financial metrics highlight our continued focus on executing at pace to embed earnings resilience and prudently managing our balance sheet, while delivering on our long-term growth priorities."

Huddle added:

With an elevated cost of capital, a disciplined approach to project prioritisation and focus on sustained value growth remain our guiding principles when deploying capital.

H1 FY24 was a busy period of strategic execution and investment, and I am delighted with the momentum that has been set and the progress we have made since we refreshed Vicinity's strategy in June 2023.

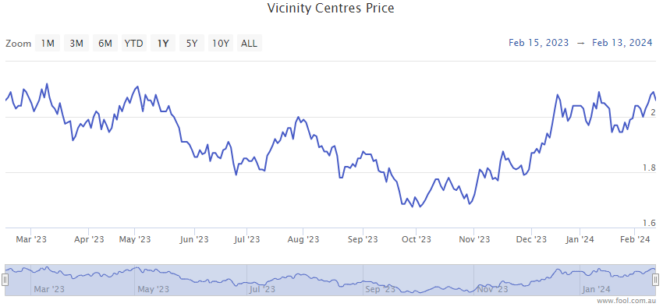

The Vicinity Centres share price is up 0.8% at $2.06 per share, having earlier posted gains of 1.5%.

That sees the ASX 200 real estate share flat over the past 12 months, not including dividends. Shares are up 23% from the 4 October lows.