It doesn't matter if you think a recession is coming or boom times are ahead, there are some businesses that are simply set up for a renaissance.

There are a couple of bargain stocks at the moment that I think are in that enviable position:

'Strong brands and a quality management team'

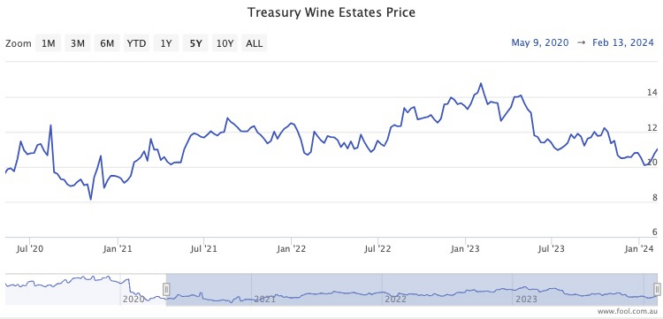

After falling more than 8% since late October, the market is getting antsy about Treasury Wine Estates Ltd (ASX: TWE).

In 2020, the company lost the Chinese export market overnight in 2020 due to diplomatic tensions between Beijing and Canberra.

But a review of the punitive tariffs in the world's most populous nation is reportedly due out next month.

With relations between the countries somewhat warmer under the current federal government, there is much anticipation that Treasury Wine could have a massive market restored instantly.

"Lifting tariffs, or significantly reducing them, should ignite demand for Treasury Wine's Penfolds brand," Shaw and Partners senior investment advisor Jed Richards told The Bull.

"The company offers strong brands and a quality management team."

Those who invest for a living are loving Treasury Wine's prospects at the moment.

According to CMC Invest, 12 out of 14 analysts believe the stock is a buy.

Ugly duckling no more?

It's been a rough few years for Credit Corp Group Limited (ASX: CCP) shares.

As a debt buyer, its business increases when consumers fall behind in their loan repayments.

First, the COVID-19 pandemic came and the market thought Credit Corp's business would go gangbusters.

It didn't.

Then inflation started rising and central banks hiked up interest rates until there were nose bleeds. Consumer wallets started getting lighter and lighter.

Credit Corp still couldn't make hay.

So after five years, the share price is disappointingly down 14.5%.

But there are signs in the last few months that Credit Corp might have finally turned a corner.

The analysts at Celeste noticed that US collections productivity showed "steady improvement" last year after an awful 2022.

"The US delinquency environment has stabilised since the AGM, with debt ledger prices significantly lower," read their memo to clients.

"The lending business experienced strong demand, with net lending guidance upgraded from $50 million to $145 million."

And guess what? The Credit Corp share price has now gained a whopping 56% since 18 October.

Plenty of experts reckon it's still a bargain stock. Six out of nine analysts currently surveyed on CMC Invest rate the stock as a buy.