The Seek Ltd (ASX: SEK) share price is taking a beating on Tuesday morning as investors react to the company's FY24 first-half results.

Shares in the online employment marketplace are down 10% to $24.25 when writing. The significant fall erases much of the ground made in the Seek share price since late October 2023. Only last month, the company's shares breached a fresh 52-week high of $26.98.

Dent in job ads taking the Seek share price down

Here are the key takeaways from Seek's latest half-year posting:

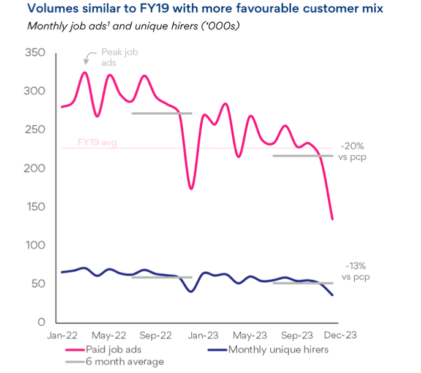

- Australian and New Zealand (ANZ) paid job ads down 20% (shown below)

- Revenue down 5% from the prior corresponding period to $596.8 million

- EBITDA down 11% to $252.9 million

- Adjusted net profits after tax (NPAT) from continuing operations down 24% to $107.5 million

- Interim dividend of 19 cents per share, down 21%

Shrinking from $626.7 million in revenue from continuing operations in the previous first half, Seek's profits carried the cost as its operating expenses remained relatively flat.

The bulk of the damage was inflicted in the company's ANZ region. Being the largest revenue source, a 10% reduction to $412 million in ANZ revenue had an outsized impact on Seek in the first half. However, the company managed to squeeze improved proceeds from the smaller base of job ads through:

- Increased variable ad pricing

- Broader use of Seek offerings

- Favourable shift in customer mix

Despite the 'more with less' achievement — and a 2% increase in Asia revenue ($123 million) — it was not enough to offset the weakness in job advertisement volumes.

What else happened in the half?

On 15 November 2023, Seek held its annual general meeting with shareholders. Filling investors with optimism, management highlighted 'significant growth potential' within the presentation, commanding a 7% leap in the Seek share price on the day.

Moreover, full-year FY24 guidance was unveiled at the AGM. At the time, management forecasted revenue between $1.18 billion and $1.26 billion. In addition, adjusted NPAT was assigned a range of $220 million to $260 million.

Today, Seek has shared revised expectations of the following:

- Revenue between $1.15 billion to $1.21 billion, 3.3% lower at the midpoint

- Adjusted NPAT between $190 million and $220 million, 14.6% lower at the midpoint

What did Seek management say?

Undeterred by the weaker results, Seek CEO and managing director Ian Narev pitched the positive from the platform unification, stating:

The highlight of this period was the delivery, ahead of time of the unified product and technology platform that will provide the foundation of our future growth. The crucial delivery stage of the project were completed exactly as planned. We can now turn our focus from the project management to realisation of the significant benefits that the platform can deliver: faster innovation and economies of scale.

Some of these benefits, as mentioned in today's presentation, include the ability to post ads across the entire Asia Pacific; advanced search and discovery using AI for candidates; and variable pricing in Asia.

What's next?

Setting expectations for the next half, Seek noted ANZ job ad volume declines could persist, with mid-teen projected. However, a further 10% increase in yield is forecast to combat some of the continued softening.

Conversely, management believes costs will be lower than originally anticipated, at $670 million in FY24.

Seek share price snapshot

The Aussie benchmark, the S&P/ASX 200 Index (ASX: XJO), has returned 2.5% before dividends over the past year. Unfortunately, despite its bustling between $20 and $27, the Seek share price is producing a subpar performance, now basically flat over the same period.