Owners of Woodside Energy Group Ltd (ASX: WDS) shares will want to know about the latest on potential deals. The ASX energy share has not given up on the idea of making an acquisition after the failed attempt to merge with Santos Ltd (ASX: STO).

There would be some great benefits to becoming a bigger business, namely relating to scale and synergy benefits. After buying the BHP Group Ltd (ASX: BHP) petroleum business, Woodside has already increased its scale.

What is Woodside considering?

According to reporting by the Australian Financial Review, Woodside is looking to expand its liquified natural gas (LNG) business. The Woodside CEO Meg O'Neill was quoted as saying:

We will keep the door open to a variety of ways to potentially grow our LNG business.

This could include buying assets and expanding existing projects, as long as they are the "right" deals.

If a LNG deal is to go ahead, any deal would need to reflect "low premiums in recent oil and gas transactions."

While Woodside has no plans to revive talks with Santos, it is looking for deals in Australia and North America. Another potential deal could excite investors about Woodside shares.

It's reportedly interested in buying LNG in the US from several export terminals and has been interested in taking a stake in the Energy Transfer LP Lake Charles project in Louisiana, according to people who are familiar with the plans.

CEO O'Neill confirmed to the AFR that Woodside is in discussions with a number of LNG developers in America.

The US recently decided to pause approvals for new LNG export projects, though O'Neill believes a review could lead to more US LNG going to the global market. But for now, O'Neill said the move is causing a "grave concern" and is "highly detrimental to investment". She suggested not all of the ripples have been felt.

Woodside is also looking at potential partnerships with the Middle East, possibly with oil giant Aramco. The Saudi Arabian giant is looking at expanding into gas, including LNG, and other related sectors like chemicals. O'Neill said:

At this point we're really just building relationships and getting to know one another. We're certainly not averse to the Middle East.

Woodside share price snapshot

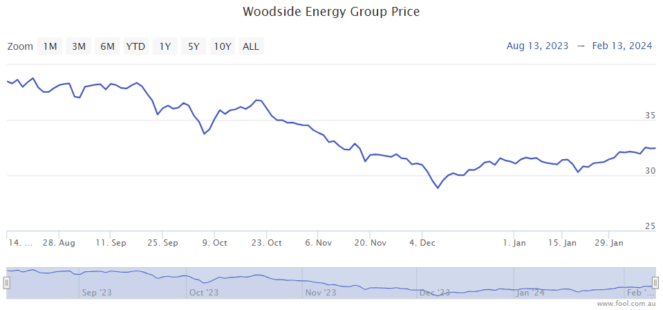

Shareholders could do with a bit of a boost, with Woodside shares down around 20% over the last six months as energy prices drifted lower.

If the business can make a deal work, then increased scale could help with margins and this could be a boost for profit. Many investors like to judge a business based on how much profit they think a business is going to make.