High growth and high yield? Who doesn't want a piece of action like that!

Moomoo market strategist Jessica Amir this week named two S&P/ASX 200 Index (ASX: XJO) stocks her team is bullish on that are both displaying some impressive numbers:

Chicken run

There is a theory that in times of economic distress, consumers turn to cheaper sources of dietary protein.

So after 13 interest rate rises, Australians could be eating less red meat and turning to more poultry.

Perhaps this is why Inghams Group Ltd (ASX: ING) is going gangbusters, rocketing 53% over the past 12 months.

"The old chicken stock is doing well and shareholders are being rewarded… and, likely, more green pastures are ahead," said Amir.

"The biggest cost for chicken businesses is wheat — which is at an all-time low. Given that 70% of the cost of growing a bird is food, this is a huge benefit to farmers."

Inghams also produces turkey, which is also cheap to produce at the moment.

"The biggest cost for turkeys is soybeans, which is down 31% at four-year lows. Revenues for Inghams; turkeys are going strong at the moment."

The financial outlook is pretty bright, with earnings forecast to rise.

"Ingham's forward earnings have been strong with a forward dividend yield of 3.3%.

"The market expectation is 95.7% earnings per share growth this year — more than last year's 73% EPS growth."

Qualitatively, Amir noted that Ingham is shifting from renting real estate to buying, which is a sign of "low debt and a strong outlook".

'High potential growth' ASX 200 stock paying 10.5% yield

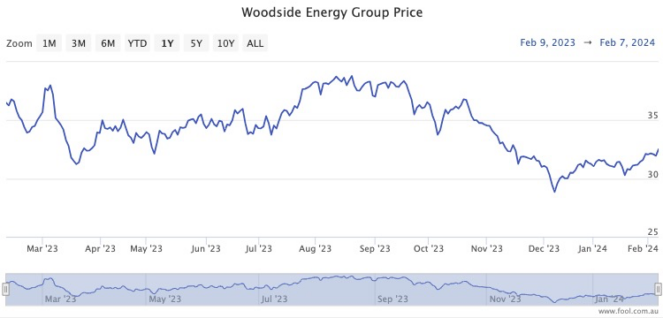

Now that a merger with Santos Ltd (ASX: STO) has been ruled out, Amir admits the Woodside Energy Group Ltd (ASX: WDS) could see some volatility in the near term.

But she cannot resist the latter's incredible 10.5% dividend yield.

"In the long-term, Woodside shows signs of high potential growth."

The caveat is the rise of nuclear-generated power.

"Nuclear energy will be the talk of the town in the coming years, led by the US, Canada and Japan.

"Woodside is looking to be more primed to pivot into the global LNG sector."

Many other professional investors are also bullish on Woodside. According to CMC Invest, eight out of 13 analysts currently rate the energy stock as a buy.