ASX dividend shares can pay an appealing dividend yield. However, larger yields can be more risky if they're in danger of being cut. How about some stocks that pay high income and they come from resilient sectors?

ASX mining shares can see commodity prices, profits, and dividends bounce around largely due to external factors. BHP Group Ltd (ASX: BHP) is a good example of that.

Retail shares can also see performance ups and downs, particularly in volatile economic times. So I wouldn't count on them for reliable income every single year either.

But healthcare is a great sector for consistency. People don't choose when to get sick or injured, as shown in the latest GDP numbers. Households and governments usually place a high importance on healthcare spending. Plus, the healthcare sector also has tailwinds, such as an ageing population and a growing population.

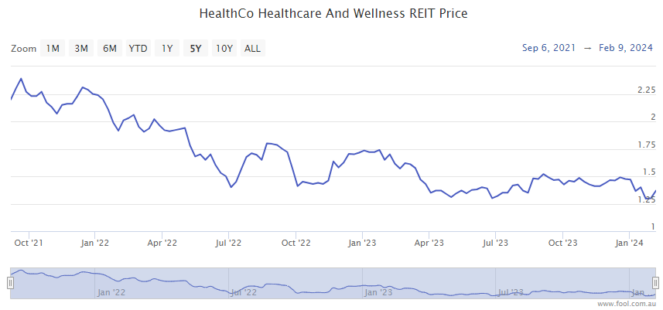

Healthco Healthcare and Wellness REIT (ASX: HCW)

This real estate investment trust (REIT) owns a portfolio of properties across hospitals, aged care and so on.

It targets "stable income characteristics including long leases, contracted rental escalations (including fixed and CPI escalations), sustainable rents and strong tenant covenants.

The business has an occupancy rate of 99% and a weighted average lease expiry (WALE) of around 12 years, which locks in a lot of rental income.

This ASX dividend share pays a distribution every quarter, so it's delivering pleasing, regular income.

It expects to pay a distribution of 8 cents per security in FY24, which translates into a forward distribution yield of 5.8%. According to the Commsec projection, it could be paying a distribution per unit of 9 cents by FY26, which would be a yield of 6.6%.

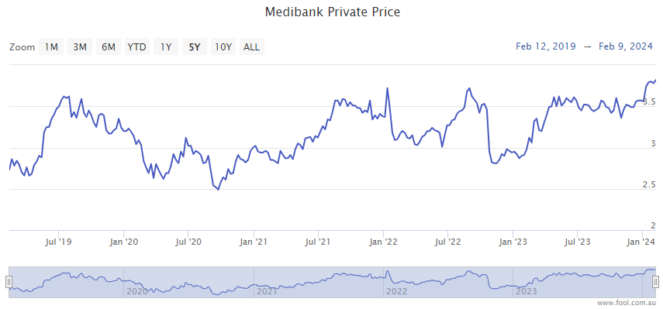

Medibank Private Ltd (ASX: MPL)

Medibank is the largest private health insurer in Australia. A lot of people appear to place a high value on having private health insurance.

It ended FY23 with more than 4 million customers and grew by 11,000 policyholders in that year. In the first four months of FY24, it added another 5,200 policyholders.

Medibank is seeing good growth in its non-resident business, which saw 40% policy unit growth in FY23.

The ASX dividend share is also looking to grow earnings with bolt-on acquisitions.

For example, it recently increased its investment in Myhealth Medical Group, which increased its shareholding from 49% to 90% for around $50.8 million. This move recognised the "critical role GPs play in prevention, early detection and ongoing care and support in the community, including people living with complex and chronic conditions". It was emphasised that GPs will continue to retain full clinical autonomy and lead the clinical teams.

For the 12 months to June 2023, Myhealth made earnings before interest and tax (EBIT) of $16 million and net profit after tax (NPAT) of $6.1 million.

According to Commsec, the business is projected to pay an annual dividend per share of 16 cents, which would be a grossed-up dividend yield of 6%. By FY26, it could be paying a grossed-up dividend yield of 6.3%, according to the forecast on Commsec.