Woodside Energy Group Ltd (ASX: WDS) shares may be in line to benefit in the medium term if a compelling oil-price prediction comes to fruition.

US company Occidental Petroleum CEO Vicki Hollub told CNBC that the oil market will face a supply shortage by the end of 2025 because the world is not replacing crude oil reserves fast enough.

What does this mean for Woodside?

This could spell good news for Woodside shares. If there is less supply than demand for oil, it could push up the oil price, which may then boost Woodside's profitability. It costs roughly the same to extract oil each month, so a boost to revenue would probably translate directly into higher net profit as well.

But, keep in mind that Woodside earns a large amount of its profit from LNG (liquified natural gas), which is a different commodity. A 10% rise in Woodside's oil earnings won't necessarily translate into a 10% in overall profit. In the HY23 result, crude oil and condensate made up US$1.76 billion, or 24%, of Woodside's overall revenue from hydrocarbons.

Oil supply forecast

According to reporting by CNBC, Hollub said 97% of the oil being produced right now was discovered in the 1900s. The world has reportedly replaced less than 50% of the crude oil produced in the last decade. The CEO said:

We're in a situation now where in a couple of years' time we're going to be very short on supply.

At the moment, the market is "oversupplied", which has kept a lid on prices despite the conflict in the Middle East. Places like the United States, Brazil, Canada and Guyana have pumped record amounts of oil as demand slows amid a faltering economy in China.

Hollub thinks the supply and demand balance and outlook will "flip" by the end of 2025. She said:

The market is out of balance right now, but again, this is a short-term demand issue. But it's going to be a long-term supply issue.

The oil-producing companies of OPEC are forecasting that global oil demand will grow by 1.8 million barrels per day in 2025 thanks to a recovery of the Chinese economy. The growth of demand is expected to beat the growth of supply of 1.3 million barrels per day by countries outside of OPEC.

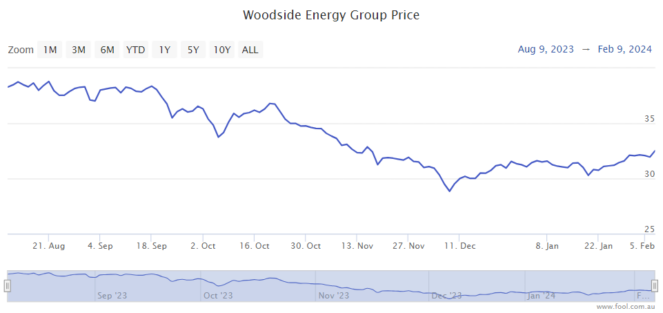

Woodside share price snapshot

Over the past six months, shares in the company have fallen 16%, so it's cheaper to invest in than it was before. Added to the prediction from the Occidental CEO, this seems to be an interesting time to be looking at Woodside shares.

And possibly lending weight to the prediction is Occidental's links with investing legend Warren Buffett. Buffett's company Berkshire Hathaway owns at least 28% of Occidental, so he likely holds its leadership in high regard.