Commonwealth Bank of Australia (ASX: CBA) shares often trade on a valuation that seems more pricey than other ASX bank shares. So should we avoid CBA shares?

Commonwealth Bank of Australia, Westpac Banking Corp (ASX: WBC), ANZ Group Holdings Ltd (ASX: ANZ) and National Australia Bank Ltd (ASX: NAB) all have fairly similar business setups. The main noticeable differences between these businesses are their size and the split between household and business lending.

So how can investors easily compare them? The valuation is one of the best and easiest ways.

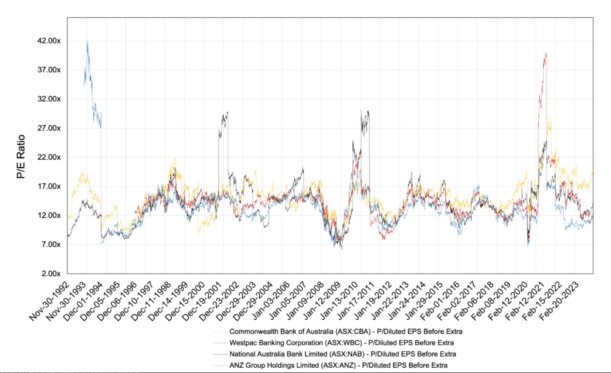

P/E ratios of big ASX bank shares

If a café makes $100,000 of annual profit and it's sold to someone else for $300,000, that translates into an earnings multiple, or price-to-earnings (P/E) ratio, of 3.

We can do a similar comparison for banks, except we're talking about billions of profit and market capitalisations that are measured in the tens of billions of dollars.

Investors in the share market normally like to think about the future profit rather than the past when valuing a business, so I'm going to compare the valuations of these businesses based on (independent) projections on Commsec for the 2024 financial year.

CBA shares are currently valued at 20 times FY24's estimated earnings, Westpac shares are valued at 13 times FY24's estimated earnings, ANZ shares are valued at 12.6 times FY24's estimated earnings and NAB shares are valued at 14.5 times FY24's estimated earnings.

We can see there is a major difference in the earnings multiple.

Just look at the chart below, showing the P/E ratio of the four banks going back to the early 1990s. It seems to be the last five or so years where CBA shares have more consistently traded on a noticeably higher earnings multiple.

Three main things affect returns for shareholders – earnings growth, changes in the earnings multiple/ P/E ratio, and the dividend.

Total shareholder returns

Despite being on a more expensive P/E ratio, CBA shares have delivered stronger total shareholder returns over the last few years.

According to CMC Markets, CBA shares have delivered an average total shareholder return (TSR) per year of 16.3% over three years and 13.6% per year over five years.

Looking at the same metrics, NAB shares have delivered an average TSR per year of 15.2% over three years and 10.4% per year over five years.

ANZ shares have delivered an average TSR per year of 8% over three years and 5.1% per year over five years.

Westpac shares have delivered an average TSR per year of 6.1% over three years and 2.8% over five years.

This seems to indicate that, historically at least, CBA's higher valuation didn't stop it from outperforming. Perhaps we could say the higher P/E ratio of CBA shares was vindicated?

Past outperformance is not a guarantee of future outperformance. CBA earnings growth will be key from here – can it keep up the quality performance of its loan book?

For me, the ASX bank share sector is so competitive that I'm not sure the next year or two will see strong profit growth from the banks. But, it's possible CBA shares could continue to positively surprise.