When Australian companies can compete on the world stage, the sky's the limit for investors.

That's because the potential of the company isn't just reliant on one relatively small population. It's diversification for the business, similar to diversification for investors.

Experts are recommending two S&P/ASX 200 Index (ASX: XJO) stocks as buys at the moment, which both represent Aussie companies exporting innovations overseas:

The ASX 200 shares offering 'value at these levels'

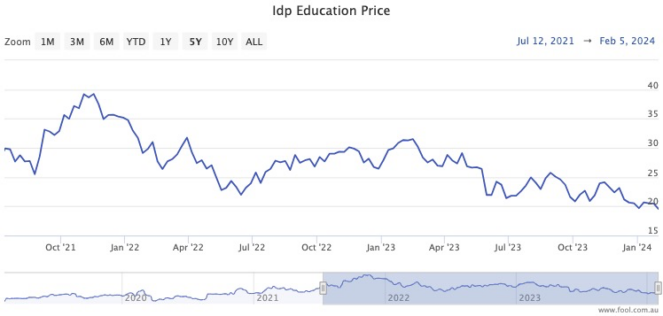

Long-time market darling IDP Education Ltd (ASX: IEL) has frustrated many investors with a 51% drop since November 2021.

Professionals and amateur investors alike thought the post-pandemic period would see a boom in overseas student placements and English language testing, which are IDP's bread-and-butter.

But market liberalisation in some countries has put a dent in their monopoly status, scaring the market.

With the stock as cheap as it is now, Sequoia Wealth senior advisor Peter Day is backing IDP from here on.

"We believe the shares offer value at these levels," Day told The Bull.

"We consider IEL as a world leader in student placement services and language testing."

Rather than a post-COVID recovery in international movement, Day reckons the big catalyst now will be the fast-growing middle class in some countries.

"We believe it's poised to benefit from continuing growth in university enrolments in emerging economies and from higher international student mobility."

The pros still like IDP, with eight of 13 analysts currently surveyed on CMC Markets rating the stock as a buy.

Cashing in on interest rates coming down

Pexa Group Ltd (ASX: PXA) switched Australia's conveyancing from paper to digital, and it's now taking that technology to other countries, such as the United Kingdom.

Even though the share price has tumbled 42% since the start of 2022, Seneca Financial Solutions investment advisor Tony Langford is a fan of Pexa.

"We expect an improvement in Australian settlement activity volumes led by stronger than forecast market sales and continued refinancing.

"With central banks expected to ease interest rates, increasing transaction volumes should support the share price."

Five out of nine analysts shown on CMC Invest rate Pexa as a buy at the moment.