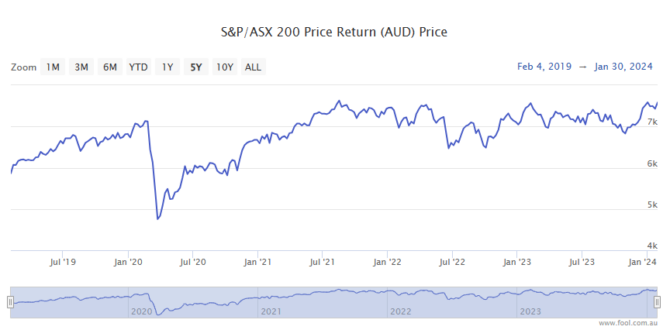

The S&P/ASX 200 Index (ASX: XJO) was down 0.4% in early morning trade today and just about flat at 11:30am AEDT. That's when the Australian Bureau of Statistics (ABS) released the latest Consumer Price Index (CPI) data.

In the minutes that followed, ASX 200 investors sent the benchmark index soaring to be up 0.3% for the day, though it's since given back much of those gains.

Here's why the latest batch of CPI data sent the benchmark index sharply higher.

ASX 200 investors celebrating CPI data

The ASX 200 is charging higher following news that inflation in Australia increased 0.6% in the December quarter and 4.1% annually. That's significantly below analysts' consensus expectations of a 4.3% annual increase in inflation.

And it represents a massive improvement on the blistering 7.8% peak annual CPI levels reported in December 2023.

This looks to be giving ASX 200 investors hope that Australia's official cash rate of 4.35% (up from a rock bottom 0.10% on 3 May 2022 when the RBA began its rapid tightening cycle) has peaked.

ABS head of prices statistics Michelle Marquardt said, "While prices continued to rise for most goods and services … this was the smallest quarterly rise since the March 2021 quarter."

The biggest contributors to the ongoing price rises Down Under were housing, up 1.0%; alcohol and tobacco, up 2.8%; insurance and financial services, up 1.7%; and food and non-alcoholic beverages, up 0.5%.

Commenting on the 1.5% increase in the price of new dwellings purchased by owner occupiers fuelling the big increase in housing prices, Marquardt said:

Higher labour and material costs contributed to price rises this quarter for construction of new dwellings. The 1.5% increase is slightly higher than the 1.3% rise in September 2023 quarter.

And renters weren't spared some extra cost of living pain either. Rental prices rose 0.9% for the quarter, down from a 2.2% increase in the September quarter. However, excluding the changes to Commonwealth Rent Assistance, rental prices would have increased by 2.2%.

Though that doesn't appear to be spooking ASX 200 investors today.

Now what?

The next RBA interest rate decision will be announced on Tuesday, 6 February.

While inflation is still more than twice the lower end of the RBA's 2% to 3% target range, today's promising figures make another interest rate hike from the central bank significantly less likely.

Though it would be premature for ASX 200 investors to factor in the first RBA interest rate cut just yet.