If you're seeking income this year, it's best to take some advice from those who specialise in that area.

IML Equity Income Fund portfolio manager Michael O'Neill warns how it's not just about buying up all the ASX dividend shares with the highest yields.

"To maximise income, investors should look for companies that pay consistently high dividends, year after year, rather than cyclical companies where dividends often fluctuate with economic cycles," O'Neill said on the IML blog.

His team's research found that "high-quality industrial companies" most often meet this criteria.

"Specifically, we look for companies which are industry leaders, with defensive earnings, growing dividends, and have a strong balance sheet."

Considering this and the current stage of the economic cycle, three income stocks are head and shoulders above the rest right now, according to O'Neill:

'Great ability to pass through higher costs to its customers'

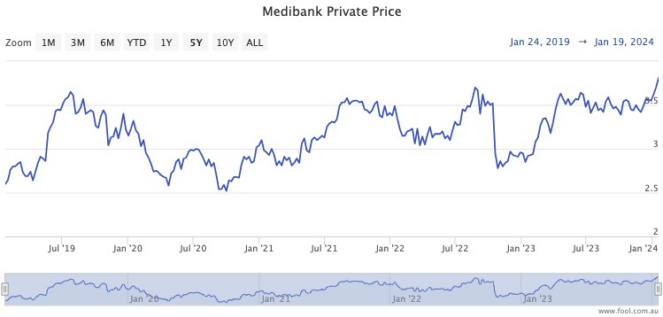

Medibank Private Ltd (ASX: MPL) shares have powered 6.6% higher so far this year.

O'Neill reckons the country's largest private health insurer is firing on all cylinders.

"It has bounced back strongly from [the 2022] cyber hack with its Net Promoter Scores (a key measure of customer satisfaction) recovering quickly and policy holders growing at around 2% pa."

He added that the business has no debt and is currently increasing profit margins through a stalling economy because of the higher interest earned from collected premiums.

"Medibank has also shown a great ability to pass through higher costs to its customers over the past year, while still increasing overall customer numbers."

Australia's ageing population is also a structural growth driver as the government continues to struggle to fund the public health system.

"This continued growth should be able to help it continue its strong dividend history," said O'Neill.

"Medibank is trading at a valuation of 17 times FY 24 earnings, and has a yield of 4.6%."

'An exemplary record' of growing dividends

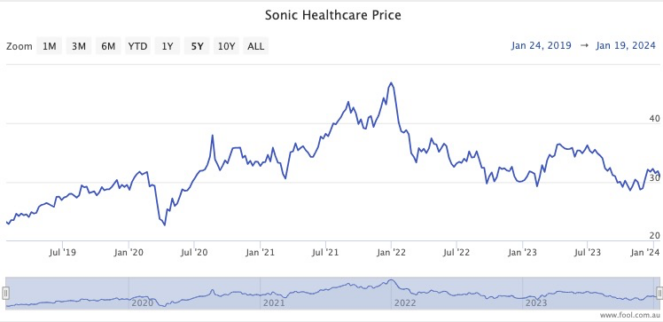

O'Neill's second tip was also related to healthcare.

The Sonic Healthcare Ltd (ASX: SHL) share price has dropped almost 32% since the start of 2022 after a two-year boost from COVID-19 testing.

That temporary boom has left the business with little debt, and O'Neill is betting it will use that financial muscle.

"This strong balance sheet has it well placed to continue to grow through acquisitions, as it has done in the past.

"Sonic is well placed to continue to benefit from the good growth prospects in healthcare. The diagnostic imaging sector also tends to be resilient throughout the economic cycle."

He added Sonic Healthcare shares have "an exemplary record" over the past two decades of growing its dividends.

"Sonic is currently trading on a valuation of 22.5 times FY 24 earnings with a dividend yield of 3.4%."

The ASX dividend shares with geopolitics going for it

Petrol refiner and retailer Ampol Ltd (ASX: ALD) is also among the top three income stocks for O'Neill.

He admitted refining crude oil is a "sunset" industry, although that does mean Ampol will not face any new competition in that activity.

And the geopolitical instability over the past two years has turned regulatory forces to Ampol's favour.

"The Australian government introduced a new policy which effectively means that refiners are guaranteed a positive margin," said O'Neill.

"So, while Ampol can still earn an attractive margin under the right conditions, effectively it cannot run at a loss, which will enhance its returns through the cycle."

Having said all that, the future driver for the business is its network of service stations.

"Ampol is also well placed to benefit from the trend towards increased sales of non-fuel retail through its large network of strategically placed property assets.

"In countries like Norway, where the transition to EVs is much more advanced, sales from non-fuel retail have increased, partly due to longer dwell times as customers re-charge their vehicles."

While the dividend growth is not quite as consistent as Sonic Healthcare, Ampol's distributions have trended upwards in the long run.

"Ampol is currently trading on a price to earnings ratio of 11 times FY 24 earnings and a yield of 6.8%," said O'Neill.

"While stocks linked to fossil fuels are priced at a discount because of ESG concerns, we know oil in some shape or form will be around and in use for decades, which makes Ampol attractive right now."