Ten years is a long time.

A lot can happen in a decade — recessions, wars, elections. So there are no guarantees, especially in investing.

However, there are some S&P/ASX 200 Index (ASX: XJO) businesses that have shown a consistent history of growth and have favourable structural drivers supporting their cause.

So investors can take some educated guesses as to which ASX shares to buy now that they can put away in the bottom drawer for the next 10 years.

Many experts would argue that every stock purchase should go through such a long-term filter anyway.

Indulge me as I pick out two ASX 200 stalwarts that are excellent candidates for locking away:

Will diet drugs suppress sleep apnoea?

Sleep apnoea device maker Resmed CDI (ASX: RMD) had well-publicised battles with critics last year.

The doubters put questions in investors' minds about how much business ResMed would lose due to the reduction in obesity brought on by new GLP-1 weight loss drugs.

The reasoning is that, as excessive weight is one of the major contributors to sleep apnoea, those diet drugs, of which Ozempic is one, could dramatically shrink ResMed's addressable market.

As such, the ResMed share price is still 20.7% down from the August reporting season.

However, this could merely represent an outstanding buying opportunity for shrewd long-term investors.

That's because multiple experts, including Shaw and Partners senior investment advisor Jed Richards, have insisted that the Ozempic fear is overstated.

"Several structural themes continue to support ResMed's growth in the medium to longer term, such as an ageing global population and an increasing awareness of sleep apnoea," Richards told The Bull earlier this month.

"Government regulation expanding the use of digital health applications provide[s] a compelling backdrop for ResMed to continue growing resiliently."

The numbers don't lie. According to CMC Invest, 18 out of 24 analysts currently believe ResMed shares are a buy.

Despite the 2023 troubles, the stock's long-term track record is impeccable. Over the past 10 years, Resmed has returned an impressive 439%.

The company delivers its latest quarterly results on Thursday.

Shares to buy if climate change can't be stopped in 10 years

Johns Lyng Group Ltd (ASX: JLG) is one of those businesses that will potentially have more work the worse climate change gets.

So that, unfortunately, means it has a strong structural driver for investors thinking of holding the stock for the next decade.

The company provides repair and reconstruction services for insurance claims.

And the wild weather of recent years has led to explosive growth in its earnings.

Earlier this month, Medallion Financial Group portfolio manager Stuart Bromley recommended Johns Lyng as a buy.

"Management has a history of exceeding expectations, with fiscal year 2023 net profit after tax (NPAT) of $62.8 million above consensus forecasts of $50 million," Bromley told The Bull.

"We expect an already strong pipeline of work to be bolstered from recent storm damage in Queensland and Victoria."

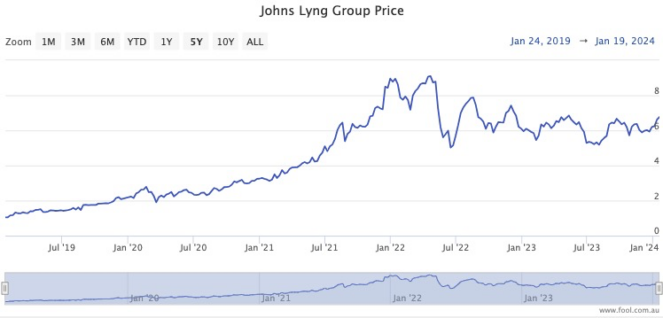

The Johns Lyng share price, accordingly, has rocketed more than 570% over the past five years.

Nevertheless, the stock is going for about 24% lower than its April 2022 peak, giving long-termers an excellent look-in right now.

Four out of six analysts currently rate Johns Lyng as a buy, as shown at the moment on CMC Invest.