It's been a tough couple of years for many Australians, especially those with a mortgage.

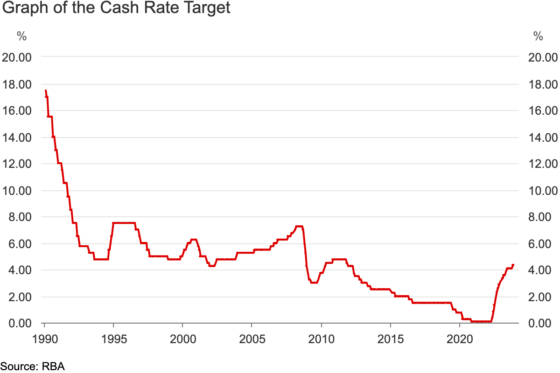

The Reserve Bank of Australia raising interest rates 12 times in 13 months, or 13 times in 18 months, is a phenomenon that's rarely seen.

It had to be done, to quell inflation from damaging levels.

But now that inflation seems to be settling down, there is great hope among economists and the public that we have seen the last of the rate hikes.

Or maybe just one more, and that's it.

While no one has a crystal ball to judge whether that's true, in practical terms the rate increases have to come to an end sooner or later.

Then after that, there might even be a reduction in interest rates to get the economy kick-started again.

And when it does, there are certain businesses that will thrive much more than others.

Here are couple of stocks from the S&P/ASX 200 Index (ASX: XJO) that have the potential to rocket if rate cuts come:

'Valuation compares favourably to its peers'

Iron ore is very much a mirror of how well the economy is going.

It is a material that is essential for construction, and that sector only gets going when consumers and businesses are confident.

So if global economies receive a stimulatory boost from interest rate cuts, the building industry could be cheering.

And that's where Champion Iron Ltd (ASX: CIA) comes in.

Champion shares are 1.6% down on 12 months ago, and that makes the price tempting to buy now, according to Fairmont Equities boss Michael Gable.

"This Canadian-based producer is trading on valuations which compare favourably to its peers," Gable told The Bull.

"We remain bullish regarding the outlook for iron ore in 2024."

Other professionals are also fans, with all seven analysts covering Champion Iron rating it as a buy on CMC Invest.

This American mob can't wait for interest rates to come down

Another victim of rising rates have been high-growth stocks, especially technology.

High interest rates harm the valuation of future-dependent companies, and Block Inc CDI (ASX: SQ2) was no exception.

Just in the first half of 2022, shares for the US fintech lost half its value.

Even within the tech sector, Block Inc was known to be profligate. Even its propensity to issue new shares to staff came into question as rates started creeping up.

But, to its credit, the company has listened to the markets and has made some changes.

"Block Inc outperformed in December following the release of its 3Q23 result the month prior, which exceeded investor expectations with respect to future cost discipline, and strong messaging about internal personnel productivity," read an ECP memo to clients.

"The result is an expectation of faster operating leverage to emerge across business units, with a plan to hit Block's 'rule of 40' in 2026."

So, in a leaner and fitter state than a couple of years ago, once rates come down Block Inc could be in an enviable position.

According to CMC Invest, all three analysts who monitor Block Inc shares reckon it's now a strong buy.