If thinking about your retirement puts you in a panic, research shows you are not alone. According to State Street Global Advisors, only 20% of Australians surveyed expect to have enough saved to fund their desired lifestyle post-work.

Unfortunately, the despairing result is down from 25% in 2022. When asked about the cause for concern, 73% of Aussies named inflation and cost of living as the negative influences detracting from a more optimistic outlook.

However, I think a comfortable retirement is within reach of most people by leveraging a simple portfolio.

My $150 per week plan to confidently retire at 60

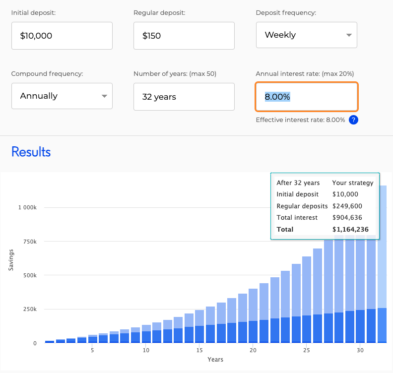

I'll be using my circumstances throughout. However, anyone can adapt to their age by using an online compound interest calculator, such as Moneysmart's, to change the timeline.

For me, I'm working on 32 years of compounding before turning 60 years old. Don't be discouraged if you are much closer to 60. Heck, even if you're 60, there's no harm in starting now to build some financial cushion by 70.

The most important part of my plan is finding $150 per week, every week, to invest for the next 32 years. For some, this might be possible from their day-to-day income. Although, if I was short on cash — for whatever reason — there are plenty of ways to make $150 in a day.

My top pick at the moment is mowing lawns. It's pretty straightforward work, using readily available tools, and can pay $55 per hour on average. Doing some extra work may not sound appealing, but if it means a comfortable retirement, I'm up for it.

I'd start by investing an upfront $10,000 accumulated through savings over the years. Approximately 70% would be invested in index-tracking exchange-traded funds (ETFs), such as the Betashares Australia 200 ETF (ASX: A200) and the Vanguard MSCI Index International Shares ETF (ASX: VGS) — the other 30% in high-quality ASX-listed companies that have the potential to grow for decades to come.

From here, I'd regularly invest $150 weekly into these ASX shares and ETFs. As shown above, this could compound to $1.164 million by the time I reach 60 (assuming an 8% per annum return).

Extending retirement without the worry

The hard part of earning and growing the retirement funds is done in this hypothetical scenario. So, how much might it improve our life outside the nine to five?

Well, it means roughly $77,600 per year before fees and taxes each year for 15 years, assuming no growth (or loss) — providing a comfortable lifestyle until I'm 75 years old. But the good times are not over yet.

See, building this additional fund with ASX shares would give my superannuation an additional 15 years to compound before use. According to my fund, that's the difference between $493,000 at 60 and $844,000 at 75 — increasing my superannuation by 71%.

As a result, I'd have another $56,260 per year for another 15 years to spend. Only then, at the ripe old age of 100, will I have exhausted my retirement funds.

Sounds like a good life to me.