You might be sick of hearing it, but that doesn't make it any less true.

The best way to grow your wealth is to invest in ASX shares for the long term.

Those who chase short-term profits might receive a windfall now and then — but overall, the chances of success are slim.

That's because no one — read no one — has the ability to deliberately time the market.

In contrast, those investors who have the patience to buy quality stocks and then let them brew for a few years are giving themselves a much better chance of making sustainable returns.

So for those readers who are genuinely in it for the long haul, here are three S&P/ASX 200 Index (ASX: XJO) stocks that the team at ECP Growth Companies Fund are backing:

ASX 200 player boasting 'global scale and multi-destination footprint'

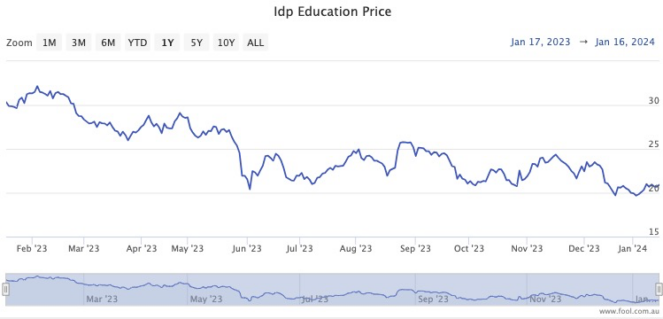

IDP Education Ltd (ASX: IEL) is a classic example of a stock facing short-term troubles, but could be rewarding for investors who can fight on.

The shares are now trading 11% lower than it was in early December. They have sunk 35% if you go back to last February as the starting point.

"IDP Education underperformed as the market digested changes to Australian migration rules and a change in CFO," the ECP team said in a memo to clients.

"While both of these have been well flagged and are not unexpected, they do represent developments for IDP to address in the near term."

However, the analysts are not concerned about the impact of these developments for the long-term outlook for the education services business.

"The Australian government has communicated that its changes to migration settings are aimed at addressing non-genuine students and improving the quality of educational institutions servicing this market.

"While these changes may affect student volumes in the short-term, the impact to IDP Education is limited given the company's global scale and multi-destination footprint."

The money is rolling in for this mob

GQG Partners Inc (ASX: GQG) shares have been going the opposite direction to IDP in recent weeks.

The investment management company has enjoyed an awesome 33% rise in its stock price since 9 November.

The ECP analysts attributed this to the flows of investment capital and a general bullishness in equity markets.

"GQG's business continues to perform to expectations, with consistent positive monthly net flows from higher fee channels and strong fund performance across all products on a rolling three-year time-frame."

The state of the business provides much assurance for long-term investors.

"This consistent alpha generation gives us confidence GQG can continue to sustain flows as it moves toward utilising its significant fund capacity."

A rejuvenated ASX 200 stock

Payments technology provider Block Inc CDI (ASX: SQ2) has returned with a vengeance to the winners' club after some ordinary stock performance since its ASX listing in early 2022.

Since the start of November, Block shares have gained a phenomenal 63%.

Although it is experiencing a 13% dip so far this year, the ECP team's faith is on show as the third largest holding in the portfolio.

The company is back in the good books with investors because of its new attitude towards expenses and cash flow.

"Block Inc outperformed in December following the release of its 3Q23 result the month prior, which exceeded investor expectations with respect to future cost discipline, and strong messaging about internal personnel productivity," read the ECP memo.

"The result is an expectation of faster operating leverage to emerge across business units, with a plan to hit Block's 'rule of 40' in 2026."