Arcadium Lithium CDI Def (ASX: LTM) shares have dropped by 16.6% since the new ASX lithium stock began trading on 22 December.

Arcadium is the new company formed from the merger of Allkem and US lithium giant Livent Corp. The merger was formally completed on 4 January.

The Arcadium Lithium share price is currently $8.44, up 1.93% for the day so far.

Upon completion of the deal, Arcadium CEO Paul Graves said Arcadium has "the resources, scale and expertise to meet the growing needs of our rapidly changing industry".

He added:

We are a leader in every major lithium extraction process – from hard rock mining to conventional pond and DLE-based brine processing – and vertically integrated, from resource to chemical manufacturing, in strategic locations around the world.

This will open doors to new opportunities and strengthen our ability to deliver value to our customers, investors, employees and communities.

But what about this 17% drop in Arcadium Lithium shares over the past month?

Is this anything to worry about?

How Arcadium Lithium shares compare to the rest

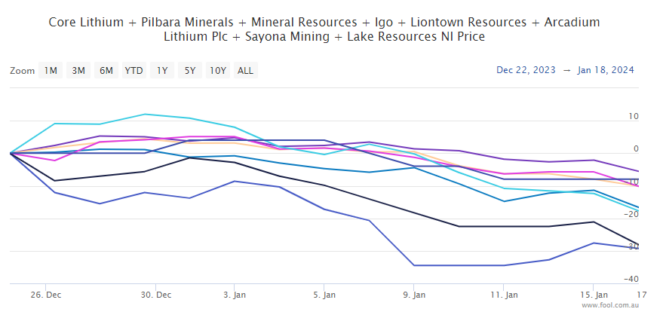

Let's compare the performance of Arcadium Lithium shares to other ASX lithium stocks since 22 December.

Since that day:

- Sayona Mining Ltd (ASX: SYA) shares are down 25%

- Core Lithium Ltd (ASX: CXO) shares are down 21.2%

- Liontown Resources Ltd (ASX: LTR) shares are down 21.4%

- IGO Ltd (ASX: IGO) shares are down 19.2%

- Lake Resources N.L. (ASX: LKE) shares are down 19.2%

- Mineral Resources Ltd (ASX: MIN) shares are down 13.4%

- Pilbara Minerals Ltd (ASX: PLS) shares are down 8.9%

As you can see, all of these ASX lithium stocks have fallen significantly over this particular time frame.

Some companies have unique factors weighing down their share prices, such as Core Lithium's recent decision to suspend mining operations at Finniss to conserve cash while continuing to process stockpiles.

But the one thing they all have in common is exposure to continuously weak lithium commodity prices.

As an example, the lithium carbonate price has fallen by more than 80% over the past 12 months. The reason for this is simply falling demand amid rising supply.

On 22 December, the lithium carbonate price was US$13,746. Today, the price is US$13,415.

This represents a further deterioration in the commodity price, down 2.4%.

In light of this, it's not surprising that the market is pessimistic about ASX lithium shares for the moment.

By the way, we recently wrote about whether lithium prices have finally bottomed.

Are Arcadium Lithium shares a good buy right now?

My Fool colleague in the US, Nicholas Rossolillo, provides his own point of view in an article published yesterday explaining why he's buying more Arcadium shares.