Telstra Group Ltd (ASX: TLS) stock is without a doubt one of the most popular blue chips on the S&P/ASX 200 Index (ASX: XJO).

And perhaps for good reason. Telstra is the most dominant telco provider in Australia by a country mile. The company has also been paying out generous dividends to ASX investors for decades, and remains a staple holding in many a share portfolio as we begin 2024.

Few would argue against the notion that Telstra is a sound company. But a sound company doesn't mean that said company's stock doesn't come with risk.

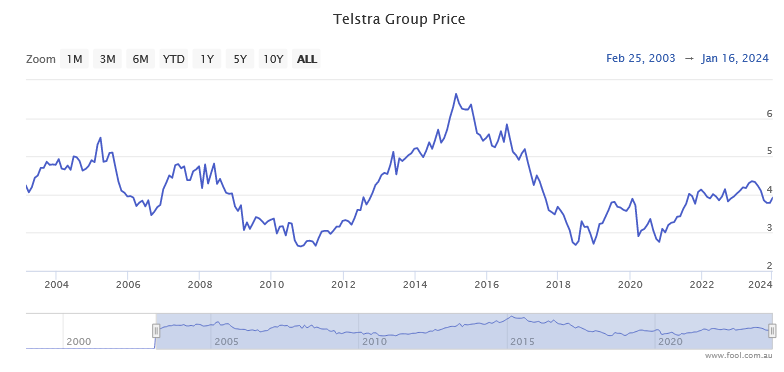

After all, Telstra stock has had quite the journey since it first hit the ASX boards in the late 1990s following its privatisation. It has traded as high as $9 and as low as $2.60 a share, as you can see below:

So where does Telstra stock stand in early 2023 – is this a high-risk or low-risk investment today? Well, let's ask an ASX expert or two.

Is Telstra stock a buy or sell in 2024?

Earlier this week, we covered the views of ASX broker Goldman Sachs on Telstra shares.

Goldman is decisively in the 'low-risk' camp when it comes to the ASX 200 telco. The broker gave Telstra stock a buy rating, complete with a 12-month share price target of $4.70.

That's a whopping 18% above the $3.98 share price Telstra is presently sitting at (at the time of writing).

Goldman is forecasting that Telstra will be able to keep increasing its dividends over the next 18 months to an annual 19 cents per share by FY2025.

Further, the broker cited Telstra's "low risk earnings" as another feather in its cap and another reason why the company is a buy today.

However, not all ASX experts are as optimistic as Goldman Sachs.

Speaking to The Bull recently, Stuart Bromley of Medallion Financial Group called Telstra stock a sell.

Noting that the company has fallen around 10% in recent months, Bromley seems to think Telstra stock is a higher-risk pick right now, and reckons investors might keep looking for returns elsewhere:

The share price of this telecommunications giant has been under pressure since mid 2022… Investors shifting out of defensive investments may look to reduce their exposure to the telecommunications sector in search of potentially bigger returns from turnaround stocks in the healthcare and information technology sectors.

So it seems there are a few mixed opinions about Telstra stock's prospects in 2024. Only time will tell who's right.