A million bucks might now be 30% below the median house price in Sydney, but it's still a lot of money.

If anything, that shows how crazy real estate is in Australia's largest metropolis, and says nothing about how valuable a million bucks is.

Seven figures can provide financial freedom, so potentially you never have to work again.

One of the best ways of reaching the magic mill is to invest in ASX shares.

Of course, there are no guarantees in life. But you're never going to have a chance if you don't at least try.

Let me show a couple of shares that experts are loving at the moment to demonstrate how you could reach the promised land:

Uranium is so hot right now

Deep Yellow Limited (ASX: DYL) is a uranium producer operating projects in Western Australia and Namibia.

The global uranium spot price has doubled in the past year as nations start to look to nuclear power to meet their energy needs in a market that's now missing a major supplier in Russia.

Nuclear power is also in favour for many jurisdictions as a method of producing huge amounts of power in return for little carbon emissions.

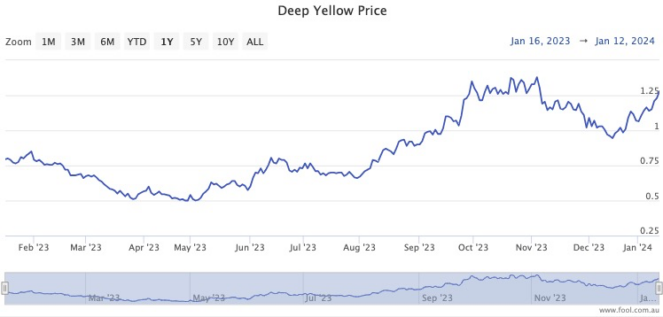

The Deep Yellow share price has climbed a stunning 97% over the past 12 months. But experts in the know believe there is more where that came from.

Last weekend's shock announcement from the world's largest uranium producer, National Atomic Company Kazatomprom Joint Stock Company (FRA: 0ZQ), that its production forecasts have been downgraded caused a frenzy in financial markets.

Uranium and uranium stocks rocketed out of fears that tight global supply would force many customers to turn to the spot market and pay market — rather than fixed — prices.

The situation showed just how sensitive the nuclear fuel market is at the moment.

All up, Deep Yellow shares have gained 232% over the past half-decade. All five analysts that cover the stock believe it is a strong buy at the moment, according to CMC Invest.

The ASX shares the experts love at the moment

Related to the energy crisis is MMA Offshore Ltd (ASX: MRM).

It's a marine services provider that lends out necessities like ships to clients with offshore facilities such as oil and gas rigs.

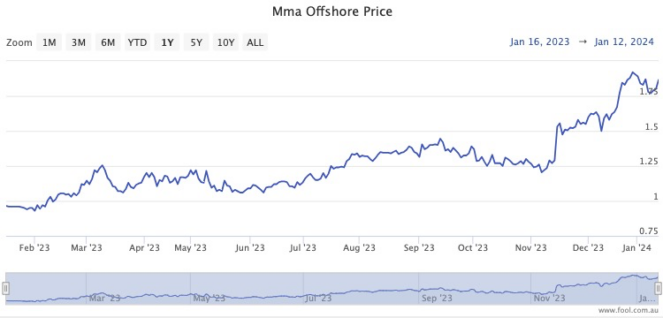

The MMA Offshore share price has literally doubled in the past year as demand for its services has gone through the roof.

Similar to Deep Yellow, this run-up hasn't put off professional investors.

CMC Invest currently shows all five analysts rate the stock as a strong buy.

After the ups and downs over the past five years, MRM Offshore shares are now trading 109% higher.

How to reach $1 million

If you are skilled and lucky enough to buy a couple of shares like these, you are in with a real shot at a million.

Over the past five years, Deep Yellow shares have returned a compound annual growth rate (CAGR) of 27.1%, while MRM Offshore has managed 15.9%.

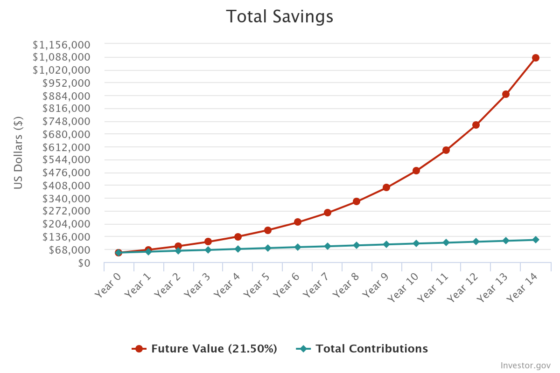

Let's say you start with a $50,000 portfolio.

The average CAGR for our two sample stocks is 21.5%. If your portfolio can grow at that rate and you keep adding $400 each month, you will reach seven figures in just 14 years.

That's an early retirement for many people.

If you start at age 30, then that's a million bucks at just 44. Even if you begin investing at 40 years old, you reach your target at 54, which is much earlier than Australia's legislated retirement age.