I love the idea of ASX exchange-traded funds (ETFs) because of the diversification and returns they can give us. There are a few that I think can be good choices for my own portfolio, or for my child's portfolio, in 2024 and beyond.

It's understandable why many Aussies focus on ASX shares – there are plenty of great choices. But, the ASX only represents a very small amount of the global share market.

For my child, I'm looking for investments that can do well over an extended period of time and that I can feel good about owning for my child. Investing in a coal miner isn't the type of choice I'd want to make. But I do like the look of the below two.

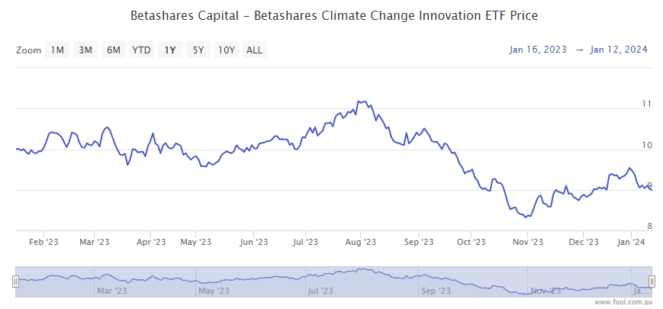

Betashares Climate Change Innovation ETF (ASX: ERTH)

This ASX ETF provides exposure to a portfolio of businesses that aim to help the world become a greener, cleaner place.

Its holdings include clean energy providers, along with companies that tackle green transport, waste management, sustainable product development, and improved energy efficiency and storage.

The ETF invests in up to 100 businesses that derive at least 50% of their revenues from products and services that help to address climate change and other environmental problems through the reduction or avoidance of CO2 emissions.

At the moment, the biggest six positions in terms of portfolio allocation are Cie De Saint-Gobain, Ecolab, Vestas Wind Systems, DSM-Firmenich, American Water Works and BYD.

There's a lot of country diversification with this ETF. Normally, globally focused ETFs have around 70% to 80% invested in the United States, whereas this one currently has 40.4% invested in US businesses. Other countries with a sizeable weighting include China, South Korea, France, Denmark, Switzerland and Japan.

Past performance is not a reliable dictator of future returns, but over the past five years, the index this ASX ETF tracks has delivered an average return per annum of approximately 15%.

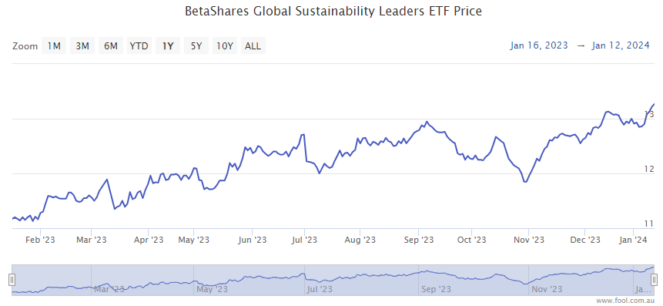

BetaShares Global Sustainability Leaders ETF (ASX: ETHI)

This ASX ETF isn't focused on one particular theme like decarbonisation, but instead, the idea is that it's invested in a global portfolio of businesses that pass a number of ethical screens.

It has a total of around 200 holdings which have been identified as climate leaders that are in the top one-third in carbon efficiency in their industry or are engaged in activities that can help reduce carbon emissions by other industries.

The ASX ETF has excluded a number of industries, such as gambling, tobacco, armaments and junk foods.

At the moment, the biggest allocations in the portfolio include Nvidia, Visa, Apple, Home Depot and Mastercard.

I like the diversification offered by this ASX ETF, as well as the solid returns. Past performance is not a guarantee of future returns, but since its inception in June 2017, it has returned an average return per annum of 16.76%.