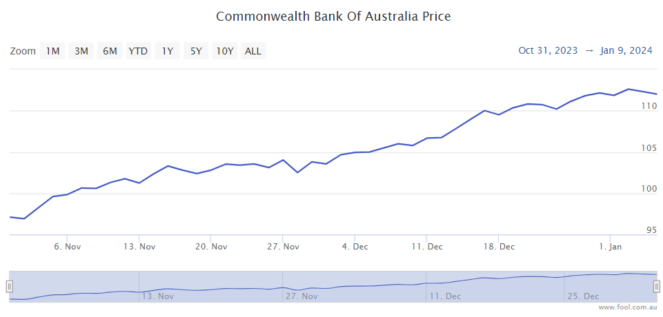

The Commonwealth Bank of Australia (ASX: CBA) share price has been impressively strong in the last few months. Since the end of October 2023, the ASX bank share has risen by 16%. In this article, I'm going to give my view on whether the company is good value.

The S&P/ASX 200 Index (ASX: XJO) has risen by around 10% since the end of October, which is still good, but the ASX bank share has outperformed.

Latest profit update

Let's have a look at the last update from the company, as this tells us how the bank is doing.

It said operating income was flat in the FY24 first quarter while operating expenses increased by 3%. The bank made cash net profit after tax (NPAT) of $2.5 billion. This was flat compared to the FY23 second-half quarterly average and up 1% year over year.

The bank said its strong balance sheet settings were maintained and reported a loan impairment expense of $198 million, with collective and individual provisions "slightly higher". Portfolio credit quality remained "sound", with credit quality indicators still near "historic lows".

Pros about CBA shares

There have been numerous interest rate hikes by the Reserve Bank of Australia (RBA) over the past 18 months. It's positive that the bank's loan book is performing so well in this environment.

CBA has a strong balance sheet, which is useful for weathering any economic storms or investing for growth. At 30 September 2023, its common equity tier 1 (CET1) ratio was 11.8%.

The ASX bank share is achieving its goal of growing its presence in the business banking world. In the three months to September 2023, its year-over-year business lending growth rate was 11.2%, which was 1.3 times faster than the overall banking system.

ASX bank share investors normally love a good dividend. The CBA dividend yield has been compressed after the strong CBA share price rise, but it's still pretty good. Using the FY23 payout, it has a grossed-up dividend yield of 5.7%. That's better than what someone can get from a CBA term deposit.

Cons to consider

While the loan book is performing well at the moment, there's no guarantee it is going to stay resilient forever. Some households are struggling and home loan arrears increased a little between June 2023 to September 2023.

The lending sector is an incredibly competitive space – there are numerous lenders offering almost the same thing. The invention of online banking has meant smaller lenders don't need a national branch to provide a competitive product. Just look at names like Macquarie Group Ltd (ASX: MQG) and ING.

This competitive landscape is putting pressure on the CBA net interest margin (NIM) – a measure which shows how much profit the bank is making on its lending compared to its cost of funding (such as savings accounts). There is strong competition for both borrowers and depositors.

For me, the most important thing to keep in mind is the elevated price/earnings (P/E) ratio.

According to Commsec, the CBA share price is valued at more than 19 times FY24's estimated earnings. That seems expensive as a standalone figure, and pricey compared to other major ASX bank shares. The National Australia Bank Ltd (ASX: NAB) share price is valued at 14 times FY24's estimated earnings and the Westpac Banking Corp (ASX: WBC) share price is valued at 13 times FY24's estimated earnings.

I don't think this is a good time to buy CBA shares, I'd be patient for a better valuation, which could happen this year if arrears start rising noticeably.