A steady second income to add to your day job is what many of us dream of when investing our hard-earned into ASX shares.

When people see the word "income", though, many think of dividend stocks.

That's fair enough. That is the most direct way of producing income with your stocks, and the ASX is full of excellent world-class dividend payers.

However, I personally like ASX growth shares for their higher potential. And the investment journey feels more interesting, watching these businesses reach new heights.

So how does one derive an income out of growth stocks?

Here's one hypothetical:

I reckon I can beat 10% dividend yield

Say I put together a $50,000 portfolio of stocks.

If it consists of dividend shares that can collectively average a yield of 10%, I'd be raking in $5,000 of second income annually.

That's $417 per month, which is not bad at all.

Maybe with franking that could be pushed up to the $500 mark.

But if I went the other route and put together a basket of growth shares, I reckon I could do better each year in terms of compound annual growth rate (CAGR).

Let's take a look at three of the hottest at the moment: Neuren Pharmaceuticals Ltd (ASX: NEU), Johns Lyng Group Ltd (ASX: JLG) and Mineral Resources Ltd (ASX: MIN).

According to CMC Invest, all three stocks are currently recommended as buys by the majority of analysts.

While past performance is never an indicator of the future of specific stocks, examining the track record of this trio gives us some idea about the power of growth shares.

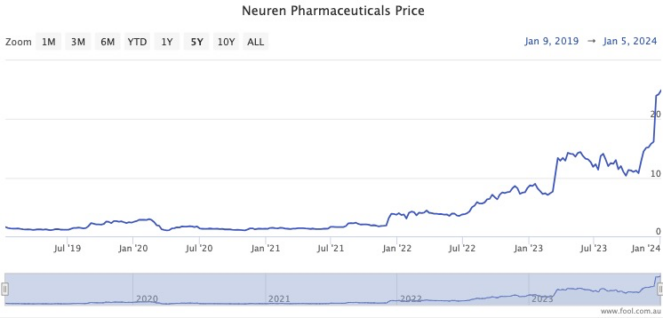

Neuren, for example, has returned a phenomenal 1,446% over the past five years. That's a mind-blowing CAR of 73%.

Johns Lyng has added 523% to its share price over the same period, equating to a 44% CAGR.

And Mineral Resources has rocketed 318% in that half-decade, returning what seems a relatively pedestrian 33% each year.

Use the capital gains discount to your advantage

Of course, no investor can expect to own a portfolio that consists entirely of these types of winners.

But with proper diversification, maybe you'll score some of these hot winners mixed with those that end up flat and others that have lost you money.

Overall, though, the maximum you can lose on a stock is 100%, while there is no limit on the amount you can win. The above three examples demonstrate that asymmetry.

This means the growth portfolio could well return more than the 10% each year that the dividend basket provided in yield.

If you go down the growth path, it means you will need to sell some shares each year to harvest that second income.

And with that, investors need to watch out for the tax implications.

Make sure, when possible, the shares you're selling have been held for longer than 12 months.

That will mean you could receive a 50% discount on the capital gains tax you pay the government on the second income.

Tax issues are highly personal, so it may be worth seeking specific advice on the way you receive cash from your shares.

Good luck with your investments.