Ahhh, the new year! A time to reflect on the year that's been and also look to the future.

Can investors bank on less volatility in 2024, or will the coming 12 months be just as much of a rollercoaster as the previous 12?

Which ASX shares will surprise to the upside? Which will come crashing down to earth? And which will be gobbled up by bigger fish?

Of course, no one knows the answers for sure. But in the spirit of looking ahead, we asked our Foolish writers to hang their hats on which ASX shares they think are destined to shine brightly by joining the illustrious ranks of the S&P/ASX 200 Index (ASX: XJO) in 2024.

Here is what they said:

6 stocks that could be future ASX 200 constituents

- Australian Ethical Investment Ltd (ASX: AEF), $597.74 million

- Chrysos Corporation Ltd (ASX: C79) $616.19 million

- Deep Yellow Limited (ASX: DYL), $867.47 million

- Cettire Ltd (ASX: CTT), $1.02 billion

- Macquarie Technology Group Ltd (ASX: MAQ), $1.61 billion

- GQG Partners Inc (ASX: GQG), $4.90 billion

(Market capitalisations as of 5 January 2024).

Why our Foolish writers have such faith in these ASX shares

Australian Ethical Investment Ltd

What it does: Australian Ethical is a wealth management company that invests its client funds under an ethical investing mandate. Now managing more than $9 billion in funds, the money manager aims to restrict investments in fossil fuel companies, gambling and tobacco without compromising on performance.

By Mitchell Lawler: Funds management can be an incredibly lucrative business if done well. As the amount of money under management increases, costs remain relatively unchanged, resulting in mouth-watering profit margins at scale.

Despite clipping the ticket at around $9 billion, Australian Ethical is still a small fry compared to other fund managers. For example, even after a mass exodus, Magellan Financial Group Ltd (ASX: MFG) oversees $35.2 billion.

In my view, Australian Ethical is well-positioned to benefit from an increasing push for capital to be invested in future-building businesses. As funds under management (FUM) grow, I think this company will begin to see those scale benefits unfold.

Motley Fool contributor Mitchell Lawler does not own shares of Australian Ethical Investment Ltd.

Chrysos Corporation Ltd

What it does: Chrysos Corporation provides technology to mining companies. Its flagship product PhotonAssay allows easier materials analysis – or assay, as it is known in the industry – than traditional methods.

By Tony Yoo: Despite mediocre results for mining stocks in 2023, this tech provider to the industry has gone gangbusters.

The stock price rocketed more than 170% in 2023 as it showed off its first significant batch of revenue in the 2023 financial year. What's more, it turned a profit.

With the global economy expected to improve in the coming years – hence mining activity picking up once again – there is no knowing how far Chrysos could go.

The company currently sits on a market capitalisation of just over $617 million, and I don't think it's too long before it makes it into the ASX 200 club.

Motley Fool contributor Tony Yoo does not own shares of Chrysos Corporation Ltd.

Deep Yellow Limited

What it does: Deep Yellow is a uranium development company. The miner has two advanced uranium projects: Tumas, its flagship project in Namibia, and Mulga Rock in Western Australia.

By Bernd Struben: The Deep Yellow share price gained 47% in 2023, giving this ASX 300 company a market cap of around $777 million. That's been spurred by surging global interest in nuclear energy, which in turn saw the uranium price rocket by around 50% in 2023.

I expect uranium prices will only rise from here, with 22 nations at Cop28 pledging to triple their nuclear power capacity. And Deep Yellow is well-positioned for more growth and a spot on the ASX 200 as a potential near-term, multi-mine producer.

Its Tumas Project alone is estimated to have a 30-plus year running life, with ore reserves of 67 million pounds. Key works have commenced at Tumas. A final investment decision is due in H1 2024.

As at 30 September 2023, Deep Yellow held $27 million in cash.

Motley Fool contributor Bernd Struben does not own shares of Deep Yellow Limited.

Cettire Ltd

What it does: Cettire is an online retailer of luxury goods. It stocks items from brands like Gucci, Versace, Fendi and Prada, amongst many others.

By Sebastian Bowen: Cettire was one of the fastest-growing ASX retailers on the market last financial year. This purveyor of fine luxury items put up some blistering growth numbers for FY23, reporting revenue growth of 87% to $539.2 million. That helped it rake in a profit of $15.97 million.

It seems that Australians love the cut-price availability of some of the most desirable items in the world that Cettire provides.

This company already has a market capitalisation of more than $1 billion. So if Cettire can keep throwing up impressive growth metrics in 2024, I think it's only a matter of time until we see this stock join the ASX 200.

Motley Fool contributor Sebastian Bowen does not own shares of Cettire Ltd.

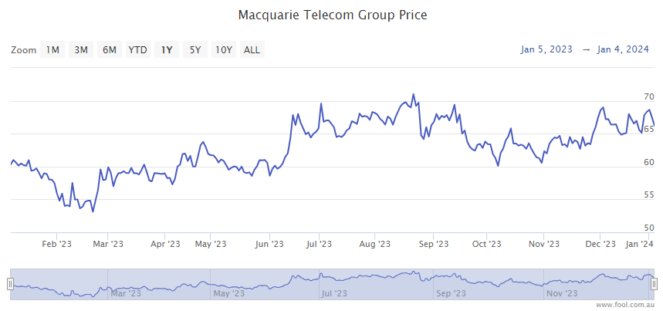

Macquarie Technology Group Ltd

What it does: Macquarie Technology is a leading provider of telecommunication, cloud computing, cybersecurity and data centre services to corporate and government customers within Australia.

By James Mickleboro: I believe that Macquarie Technology could join the ASX 200 index in 2024. Especially if it continues its impressive performance in FY 2024 and delivers its 10th consecutive year of earnings before interest, taxes, depreciation, and amortisation (EBITDA) growth.

Goldman Sachs expects the company to achieve the latter. In fact, thanks to "a third wave of demand for data centre providers" from generative AI (ChatGPT etc), the broker is forecasting the company's EBITDA growth to continue until at least FY 2026.

It is because of this that the broker is very bullish on Macquarie Technology and has a conviction buy rating and a $77.70 price target on its shares.

Motley Fool contributor James Mickleboro does not own shares of Macquarie Technology Group Ltd.

GQG Partners Inc

What it does: GQG is a US-based fund manager that focuses on four main strategies: US shares, global shares, international shares and emerging market shares.

By Tristan Harrison: The business is far bigger than plenty of others within the ASX 200. At the time of writing, GQG has a market capitalisation of around $4.7 billion. In contrast, one of the smallest stocks in the ASX 200 — IPH Ltd (ASX: IPH) — has a market capitalisation of around $1.6 billion.

GQG is making a profit, paying solid dividends and experiencing good funds under management (FUM) inflows and growth.

The biggest issue for GQG to get into the ASX 200 could be the liquidity requirements being a minimum relative liquidity of 50%.

Chair and chief investment officer Rajiv Jain's entity owns more than two-thirds of the business, which is usually a good sign of management's commitment. For immediate ASX 200 inclusion though, the ownership makes it tricky. However, GQG may be able to improve liquidity during 2024.

Motley Fool contributor Tristan Harrison does not own shares of GQG Partners Inc.