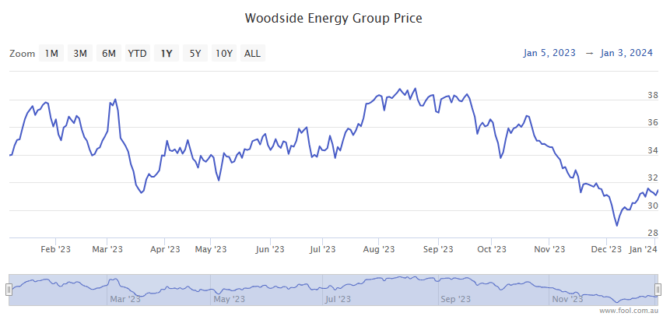

The Woodside Energy Group Ltd (ASX: WDS) share price sank by 12.4% in 2023.

Shares in the S&P/ASX 200 Index (ASX: XJO) energy stock closed out 2022 trading for $35.44. When the closing bell rang on 29 December sounding the end to trading for 2023, shares were swapping hands for $31.06 apiece.

For some context, the ASX 200 gained 9.3% for the calendar year.

Of course, we're not including the $3.40 in fully franked dividends paid out by Woodside over the year.

If we add those back in, the accumulated value of the Woodside share price lost a lesser 2.7% in 2023, with some potential tax benefits from those franking credits.

Here's what ASX 200 investors were considering during the year.

What moved the Woodside share price in 2023?

The Woodside share price, as you'd expect, is heavily influenced by the current market prices and future outlook for the gas and oil prices.

And in a volatile year for energy, the Woodside share price saw some significant swings higher and lower over the course of the year.

Brent crude oil ended 2022 trading for US$85.91 per barrel. The oil price hit lows of US$72.76 per barrel on 27 June before racing to highs of US$96.55 per barrel on 27 September. Brent crude closed out 2023 trading for US$77.04 per barrel, down 11.3% over the year.

Natural gas price moves on the spot market broadly mirrored the swings in the oil price.

On 15 September, as the Brent crude price was barrelling higher, the Woodside share price closed the day trading for $38.39. That put shares up 8.3% in 2023, without including the dividends.

But slumping energy prices threw up some headwinds after that, which saw the ASX 200 energy stock tumble 19.1% from 15 September through to the end of the year.

What else happened with the ASX 200 oil and gas stock in 2023?

Aside from enduring some volatile energy prices, Woodside had a pretty strong year.

For its half-year results, Woodside reported a record H1 net profit after tax (NPAT) of US$1.74 billion, up 6% year on year. And the company had positive free cash flow of US$294 million.

Still, the Woodside share price lost 1% on the day the company reported those results.

Investors may have been underwhelmed by the 6% year on year fall in earnings before interest and taxes (EBIT), which dipped to $2.79 billion. And passive income investors won't have been pleased with the 27% decline in Woodside's interim dividend.

Other issues that ASX 200 investors were keeping an eye on, is the ongoing regulatory approval process for Woodside's massive $16 billion Scarborough LNG project, located in Western Australia.

And after market close on 7 December, Woodside officially confirmed rumours that it was discussing a potential merger with rival ASX 200 energy share Santos Ltd (ASX: STO).

While that merger has the potential to benefit both companies over the longer term, the Woodside share price closed down on 8 December as investors digested the news, while the Santos share price closed sharply higher.

That's likely because Santos shares are seen to be trading at a significant discount to Woodside shares, meaning for the merger to proceed, Woodside will likely have to pay for that added value.