With a new year underway, investors may be looking around for some ASX 200 stocks to research for potential investment.

That's smart, given many companies struggled to grow or even maintain their valuations in 2023 amid high interest rates and inflation and persistent concerns about China's economic health.

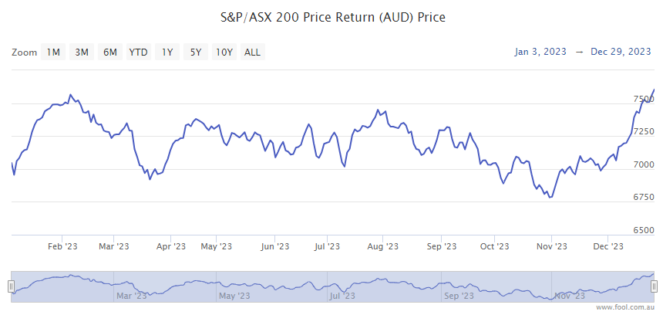

It's worth remembering that S&P/ASX 200 Index (ASX: XJO) stocks weren't doing so well up until November. At the market close on 31 October, ASX 200 stocks were down 3.4% for the year to date.

But the early Santa rally, prompted by expectations that the US Federal Reserve would cut rates in 2024, created a strong end-of-year finish. ASX 200 stocks rose by 11.9% from 1 November to 29 December alone. Final outcome for 2023: An 8.1% gain for ASX 200 stocks overall. But not all of them were winners.

Moving on to 2024…

So, where do you start your research when looking for cheap shares to consider for investment?

Well, one rule of thumb that some investors use to spark ideas is looking for ASX 200 stocks with a price-to-earnings (P/E) ratio of 15 or less.

The P/E ratio is also called the 'earnings multiple' or 'price multiple'. It measures a company's current share price against its earnings per share (EPS) in one handy data point.

Generally, a P/E below 15 indicates good value, with the caveat that a fundamental analysis of each share must follow. This is because a low P/E might indicate expectations of lower future earnings due to short-term variables like subdued retailing, fluctuating commodity prices, or poor investor sentiment.

In other words, it's important to find out why the P/E is low before you buy.

Which ASX 200 stocks have attractive P/Es?

In this article, we're focusing on ASX 200 stocks representing established businesses only.

These are not buying recommendations. We're just highlighting six examples of ASX 200 stocks with P/Es below 15 right now, according to CommSec data.

Qantas Airways Limited (ASX: QAN)

Qantas shares are trading on a P/E of 5.72 times. The Qantas share price closed on Thursday at $5.28, down 0.75% for the day. The low P/E is partly due to a 14.3% drop in the share price over the past six months.

The reasons: Poor customer service, flight cancellations, the $21.4 million earnings of departing CEO Alan Joyce, a class action lawsuit over cancelled flights during the pandemic, a court ruling that Qantas illegally sacked workers, and the ACCC alleging it sold tickets on flights already cancelled. Yeah, not happy Jan!

Despite all this reputational damage, Goldman Sachs has a conviction buy rating on the ASX 200 travel share with a 12-month share price target of $8.25.

Santos Limited (ASX: STO)

Santos shares are trading on a P/E of 9.19 times. The Santos share price closed at $7.66, up 1.32% for the day and up 11% over the past 12 months.

Santos CEO Kevin Gallagher can't believe the value on offer, stating back in October when the share price was about $7: "The share price is very frustrating. It's cheap. It's stalled." Challenges for Santos include project delays caused by environmental lawsuits and regulatory issues.

News of a potential takeover by Woodside Energy Group Ltd (ASX: WDS) surfaced in early December. My colleague Bernd recently wrote about the three big things that will impact the Santos share price in 2024.

QBE Insurance Group Ltd (ASX: QBE)

QBE shares are trading on a P/E of 9.86 times. The QBE share price finished at $14.74, down 0.34% for the day. ASX insurance shares were among a small group of ASX 200 stocks that directly benefitted from rising inflation in 2023.

The big insurers raised their premiums by 10% to 20%, industry competition remained the same, and investment income from rising bond yields improved. Some fund managers switched from ASX 200 bank stocks to insurance shares in light of this.

Morgans says QBE has a positive earnings profile and cheap valuation despite its 11% share price rise over the past 12 months. The broker has an add rating and a 12-month share price target of $17.46.

IGO Limited (ASX: IGO)

IGO shares are trading on a P/E of 8.43 times. The IGO share price closed at $8.69, down 1.8% for the day. Last year was a pig of a year for most ASX lithium shares due to crashing commodity prices. The lithium carbonate price fell from US$82,520 per tonne in November 2022 to US$13,865 per tonne at the close of 2023.

This has been caused by a global oversupply and weaker demand for electric vehicles as the world's major economies struggle. In light of this, IGO is now stockpiling surplus lithium at its Greenbushes mine and may cut production in 2024. But it's worth remembering that IGO is a very low-cost lithium producer.

This is one of the reasons why Bell Potter reckons IGO shares are a buy. The analysts argue it has been oversold after falling 35% over 12 months. They have a share price target of $11.30 on the ASX 200 stock.

New Hope Corporation Ltd (ASX: NHC)

New Hope shares are trading on a P/E of 5.72 times. The New Hope share price finished at $5.31, up 0.95% for the day. New Hope took a beating alongside other ASX coal shares in 2023 due to commodity prices falling from record highs. The ASX 200 stock has lost 9.5% in value over the past 12 months.

In an update covering the three months to October, New Hope said the uncontracted market for high-quality coal had been limited and heavily discounted, but it had no unsold supply through to January 2024.

My colleague Bernd reckons New Hope shares are great value at the $5 mark. He explains why they're at the top of his list of attractive dividend stocks in the marketplace today.

The Star Entertainment Group Limited (ASX: SGR)

Star Entertainment shares are trading on a P/E of 3.5 times. The Star share price closed at 52 cents, up 1% for the day. Star shares were among the worst-performing stocks of 2023, booking a 65% implosion in the share price.

The casino and resort operator is neck-deep in expensive remediation work after being found unsuitable to hold a casino licence in both NSW and QLD. It reported a $1.3 billion loss for 1H FY23 and conducted two capital raisings worth a collective $1.55 billion last year to help it cover medium-term liabilities and operations.

Despite all of this, Morgans has an add rating on the ASX 200 stock with a share price target of 70 cents.