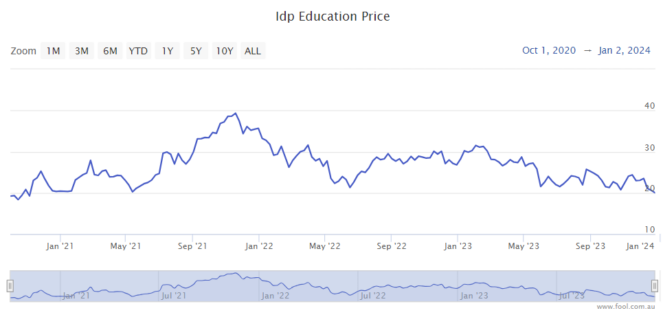

The Idp Education Ltd (ASX: IEL) share price has suffered a significant sell-off over the past 11 months, down close to 40%. Hence, is it the right time to invest in this beaten-up ASX share? I'm going to look at that question in this article.

IDP Education is involved in English language teaching in various countries and it also administers English language testing across more than 80 countries. The ASX share now has more than 200 student placement offices in 35 countries.

Profit growth is strong

The business has delivered a lot of profit growth over the years, with the FY23 result demonstrating good numbers.

FY23 revenue rose by 24% to $982 million, adjusted earnings before interest and tax (EBIT) climbed by 40% to $228 million and the net profit after tax (NPAT) improved by 45% to $154 million.

The broker UBS thinks FY24 will see more growth, with potential EBIT growth of around 18% to $266 million, net profit growth of 11.7% to $172 million and earnings per share (EPS) growth of 12.7% to 62 cents.

In FY25, IDP Education's EBIT could jump again to $331 million, net profit could rise to $217 million, and EPS could rise to 78 cents, according to UBS.

However, there's more to the situation than just the most recent numbers. The market seems to think the company is facing headwinds. For example, less than a year ago, the company acknowledged Immigration, Refugees and Citizenship Canada published a decision on its website to recognise additional providers for English language proficiency for the Canadian Student Direct Stream (SDS) visa scheme. Before this, IDP Education and the British Council had administered the only recognised English language proficiency test for the Canadian SDS visa scheme.

Reasons to still like this business

The broker UBS thinks there are still positives, such as the "ongoing student placement recovery" combined with "strong market share gain opportunities (and acceleration potential through Fastlane)."

UBS also said IDP Education has a solid competitive position in English language testing, which is improving with the roll-out of its 'One Skill Retake'.

The IDP Education share price is very close to its 52-week low, it's as cheap as it's been since late 2020.

Based on the earnings estimate for FY24, it's valued at 32 times forward earnings. UBS thinks it's a buy. While I'm not as bullish as UBS, which has a price target of $30.45, it could be an interesting one to look at considering it has fallen so much.