There is no guarantee that ASX shares will make you a millionaire.

But you certainly won't have a chance without investing!

To demonstrate the awesome power of shares and compounding, let's see how one ASX mining stock could deliver you to seven digits:

Not just mining services

Mineral Resources Ltd (ASX: MIN) is often described as a mining services company, but it has significant operations of its own to dig up iron ore and lithium.

And it's those activities that have investors excited.

"Mineral Resources' business is undergoing considerable growth in the iron ore, lithium and energy units," Bell Potter analysts David Coates and Bradley Watson said in a memo to clients.

"Resulting production growth is forecast to increase earnings over the next two years and provide improved leverage to lithium and iron ore prices, from a lower unit cost base."

Many of their peers agree, with 13 out of 18 analysts currently surveyed on CMC Invest rating the mining stock as a buy.

Impressive track record

So what has MinRes' growth been like? Could it be a millionaire maker?

Past performance, of course, is no indicator of what the future holds. And a healthy portfolio should always be well diversified, rather than have all the eggs in one basket.

But Mineral Resources' track record is pretty impressive.

New Zealand entrepreneur Chris Ellison co-founded the company almost 20 years ago and still steers the ship as chief executive.

Over the past 10 years, the share price has rocketed more than 505%.

That makes it a 6-bagger, without counting dividends.

The dividend yield currently stands at a not-insignificant 2.7%, fully franked.

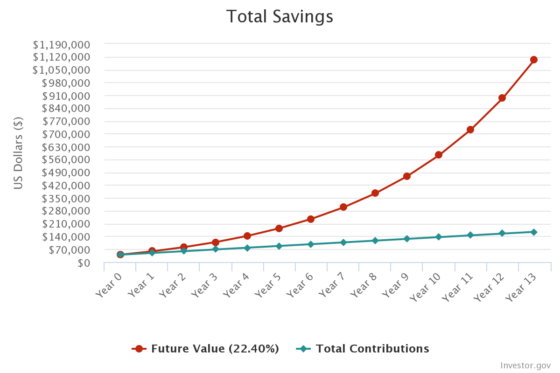

That capital growth and yield adds up to a compound annual growth rate (CAGR) of 22.4%.

This means that if you started with a parcel of $40,000 Mineral Resources shares and you kept adding $800 each month, after 13 years your investment would be worth $1,103,944.

Amazing. You just turned $40 grand into a million in just 13 years.

Buy at the low point of the cycle

As mentioned, many experts are excited about MinRes' prospects for the future.

This is especially so because the economic cycle is at a low point. From here, once interest rates start stabilising in the west and Chinese consumers come out of their shell, minerals will be in hot demand.

Just remember, you may not become a millionaire, but you give yourself no chance if you don't invest.

Good luck out there.