As you spend time with your family these holidays, do you wish you could relax like that permanently?

Quitting work for good with a million bucks to your name is not as far-fetched as it sounds.

A million dollars combined with 10% annual returns will allow you to retire with $100,000 of passive income each year for the rest of your life.

Allow me to show you some hypotheticals that use the power of ASX shares and compounding to make that happen:

3 ASX shares that have grown in the long run

Although there are many paths to the destination, I personally favour ASX growth shares for building up to the magic million.

I find it lower maintenance to not have to worry about reinvesting dividends, both in terms of stock picking and tax paperwork.

Three examples that are tempting buys at the moment are Lovisa Holdings Ltd (ASX: LOV), Avita Medical Inc (ASX: AVH) and Vaneck Morningstar Wide Moat Etf (ASX: MOAT).

Past performance is never an indicator of what will happen in the future. However, we can use their track record to demonstrate how fast your investment could reach a million bucks for retirement.

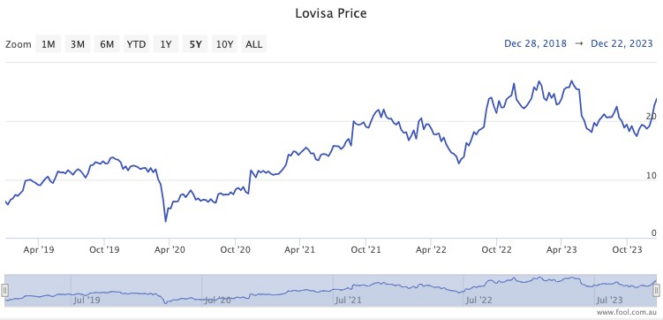

Over the past five years, the Wide Moat ETF has added 102% to its share price, Avita Medical has gained 171%, and Lovisa shares have rocketed 297%.

That's not bad considering that half-decade has included serious market shocks like the COVID-19 crash and the 2022 inflation sell-off.

A million in 16 years

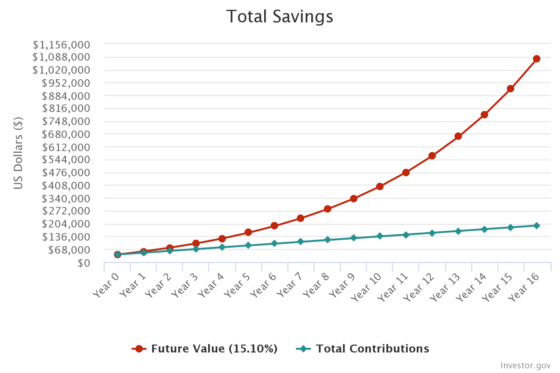

Let's say conservatively that you're unable to pick the next Avita or Lovisa, but can manage to put together a portfolio that can perform similarly to the Wide Moat ETF.

That will provide a pretty decent compound annual growth rate (CAGR) of 15.1%.

If you start with the average Australian savings level of $40,000 and you can add $800 to it each month, the pot will grow nicely if you can show patience.

Based on monthly compounding, if you can have the discipline to keep the portfolio going for 16 years, you will have reached $1,079,219.

There's the million you craved.

Sixteen years may sound like a long time, but for many that will allow an early retirement.

If you're 30 years old now, that means finishing work at 46. If you're fortunate enough to be reading this at 25, you could potentially put your feet up at 41.

Even if you're 40, that's retirement at 56, which is years ahead of the mandatory threshold of 67 years.

How good would that be!