Even though share markets can be volatile, if you can stick with your investments for an extended period the rewards can be pleasing.

In fact, I put it to you that directing just $200 each month to buying ASX shares could later bring in $34,000 of annual passive income.

What could you do with an extra $34,000 each year?

You could buy a new car in some years. A luxury overseas holiday is not out of the question with that sort of cash.

The passive income could even just take care of your mortgage repayments, allowing you to devote your day job wages to other expenses.

First, build up your nest egg

Research this year by comparison site Finder found the average Australian has $40,000 saved up.

If we start a well diversified portfolio of that size then keep adding to it regularly, the pot will grow nicely using the power of ASX shares and compounding.

With Australia's franking laws and generous dividends, it is not out of the question to achieve a compound annual growth rate (CAGR) of 12%.

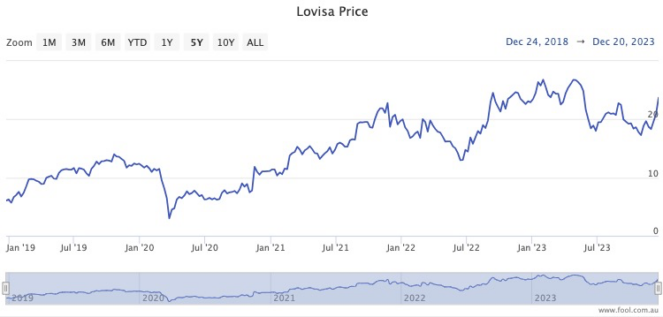

Take Lovisa Holdings Ltd (ASX: LOV) as an example from the S&P/ASX 200 Index (ASX: XJO).

The share price has rocketed 288% over the past five years, so you could easily label it a growth stock.

But the jewellery retailer also pays out a handy 2.9% dividend yield, which is 70% franked.

Investors fortunate enough to have held Lovisa in their portfolios over the last half-decade have thus enjoyed a sensational 34% CAGR.

Then crack that egg open

Back to the $40,000 portfolio.

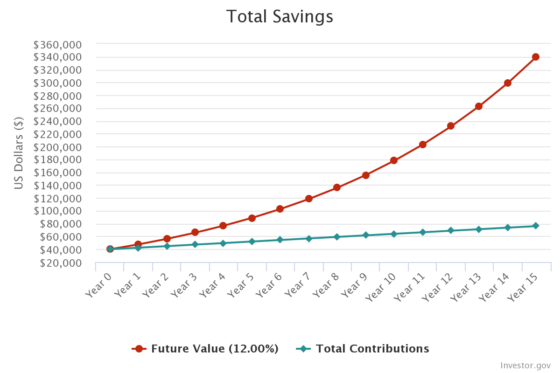

Let's construct a diversified stable of quality ASX shares then keep buying $200 more each month.

With a CAGR of 12% compounded monthly, after 15 years that stash will have reached $339,748.

Even if your portfolio has cooled off to a 10% return by then, that's a passive income of $33,974 each year if you sell off gains.

Mission accomplished.

Of course, the stock market is full of risks, so you will need advice to shape your portfolio along the way.

Whether it's general advice from a service like The Motley Fool or personal advice from a professional planner, it is wise to not trek alone.