It's now just over a year since the release of ChatGPT to the public unleashed absolute mayhem.

Not only did it send investors scrambling for potential winners from the artificial intelligence (AI) race, mainstream society was pondering what sort of implications the technology would have on jobs and ethics.

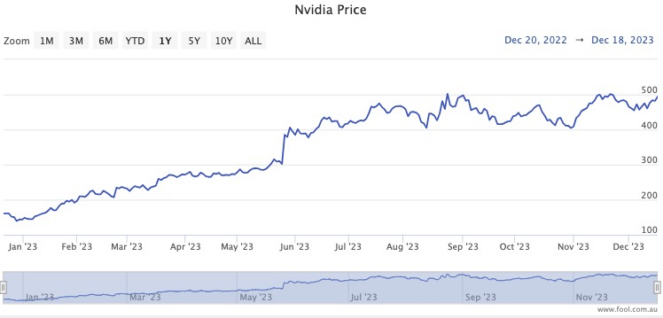

Now, 12 months later, it's clear one of the massive winners was Nvidia Corp (NASDAQ: NVDA) and its shareholders.

Incredibly for a 30-year-old company, the stock price has soared almost 250% this year.

So if you're now looking to invest in AI, is it already too expensive?

Probably.

There are certainly other tech shares I can see that have similar associations to AI but have less demanding valuations.

Let's check out one of those:

Picks and shovels

One thing investors need to be clear on about Nvidia is that the company itself doesn't produce artificial intelligence.

Rather, it makes the powerful computer chips that are necessary to run AI software.

It's a typical "picks and shovels" story, where the guy selling the spades makes more money than most of the miners looking for gold.

Did you know there is a mob over in the Netherlands who are supplying the picks and shovels to the picks and shovels makers?

ASML Holding NV (NASDAQ: ASML) provides extreme ultraviolet (EUV) and deep ultraviolet (DUV) lithography machines that the computer chip makers need to print tiny patterns onto chips.

The Dutch company has a monopoly on this technology, especially for high-power computer processors that require nanoscopic etchings.

The Motley Fool US tech expert Keithen Drury explains it best:

"The latest and greatest in chip design is a 3nm chip, which means the distance between transistors is at a minimum of 3nm wide. For reference, a human hair is between 80,000 and 100,000 nanometers wide.

"While only a handful of companies can manufacture 3nm chips, only one creates the machines that make this technology possible: ASML."

And this is why I think ASML makes a great long-term investment for the AI revolution.

This AI stock is cheaper than Nvidia

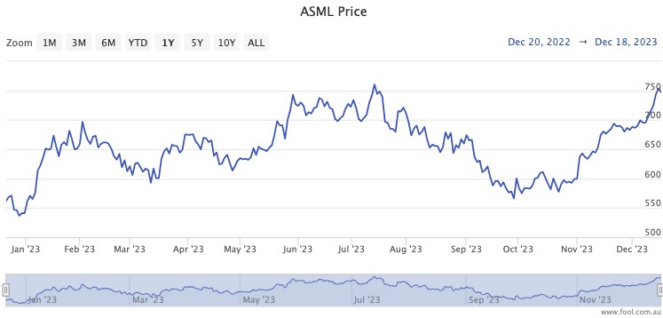

Although the ASML share price has risen a chunky 35% this year, it hasn't exploded to the extent of Nvidia, making the stock decent value for those buying now.

Drury noted how ASML shares are currently "undervalued", as they currently trade "well below their five-year historical average PE ratio".

Over the past five years, the ASML stock price has increased five-fold.

One risk to note is any escalation in geopolitical tensions with China.

Already Europe and the US are restricting export of certain technologies to the Asian giant, based on security concerns.

ASML has a large customer base in China, according to Drury, and any further political restrictions could jeopardise the company's growth.

"There is always a possibility that ASML may be prohibited from exporting any of its products to China, which would be an issue, as 46% of ASML's Q3 and 24% of Q2's new machine sales came from China."