Owners of Westpac Banking Corp (ASX: WBC) shares are in for some extra Christmas cheer on Tuesday. That's because the ASX big four bank's dividend is being paid to investors today. It's a fairly large payout, which is pleasingly coming right before Christmas. In this article, you can learn all about the payment.

This dividend that's being paid is the final dividend payment of the 2023 financial year.

Westpac dividend

Westpac shareholders are getting a dividend payment of 72 cents per share. That's a fully franked payment, so investors get the full benefit of franking credits as well.

Some investors may have opted to re-invest their dividends via the dividend reinvestment plan (DRP). These DRP shares are priced at $21.27, which is a discounted price compared to the current Westpac share price of $22.48.

At the current Westpac share price, the incoming dividend represents a dividend yield of 3.2% or 4.6% grossed-up. That's a sizeable yield for just one payment.

This half-year payment brings the full-year dividend to $1.42 per share, an increase of 14% compared to FY22. The payout came after the ASX bank share delivered a 28% increase in the earnings per share (EPS) to $2.05.

Can the payout keep increasing?

The projection on Commsec certainly suggests so – the annual dividend per share is projected to increase slightly to $1.435, which would be a grossed-up dividend yield of 9.1%.

However, the EPS for FY24 is projected to decline to $1.80 per share amid the competitive banking scene and possibly higher arrears due to higher interest rates.

At the current Westpac share price, it's valued at around 12.5x FY24's estimated earnings. That's still a relatively low price/earnings (P/E) ratio considering the double-digit profit decline that is being forecast.

Ultimately, the Westpac dividend and share price are going to be influenced by what profit the ASX bank share is making, so what happens in the subsequent years with earnings could be key.

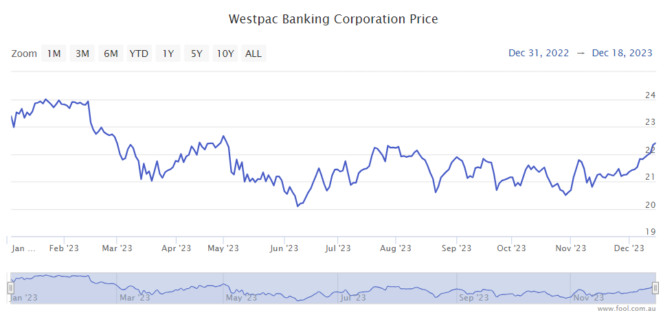

Westpac share price snapshot

Compared to the start of 2023, Westpac shares are almost exactly where they were at the start of the year.